Investing is an important part of your financial life. What’s more important is investing for the long-term.

With a long time horizon, you have the ability to ignore short-term market volatility and you have the ability to let your investments compound over time.

Investing this way can be difficult, however, so here are some tips on how to do that.

Pick a strategy and stick with it

You need to pick and stick with what works for you. There are several strategies that you could choose.

Value – A strategy that involves a deep dive into company/industry fundamentals. Companies/industries in this area may or may not be out of favor. All you care about is how the underlying fundamentals look.

Growth – High flyers. Companies with high P/E ratios. Companies that have a strong case for continued growth. Sectors like technology and consumer discretionary are considered growth.

Contrarian – If you buy when others sell or sell when others buy, you may be a contrarian investor. You go against the herd. Someone who does this has a unique ability to be extremely objective.

Momentum – You invest in companies or sectors that are performing well and are fairly likely to continue that trend going forward.

Start early

This is no secret, the earlier you start the better. Albert Einstein once said, “Compounding is the eighth wonder of the world.” It really is amazing what compounding can do. If you have 20, 30, or 40 years to invest, you should be sitting pretty at that finish line.

For example, say you have two investors. One investor starts contributing $1,000 per month to an account and invests in a stock market index ETF, starting out at 25 and stops contributing after 10 years.

Another investor starts contributing $1,000 and that same index ETF, starting at 35 and they contribute until they turn 65. At age 65 person A ends up with 1.49 million, and person B ends up with 1.26 million.

Compounding truly works wonders. Start early and give compounding a chance to work its magic.

Make every move with the future in mind

Every decision that you make needs to be a slow and thoughtful one. It’s particularly important to make decisions with your future self in mind. Delayed gratification is HUGE when investing for the long term.

For example, you have your debts paid off and now have a little extra money each month. You decide that you want to buy a boat. You save up and pay $20,000 for a nice, new boat.

Here’s the flip side. Say it took you three years to save up for that boat. Instead of saving, you deposited $5,500 per year into a Roth IRA (max contribution amount). This is invested in a stock market index ETF we mentioned earlier.

Now, let’s go out 10 years. You still have that boat and have taken good care of it. However, it’s lost over 50% of value over that time period. Conversely, that $16,500 that you invested has grown to $33,600.

Buying the boat may have felt good before, but investing that for the long-term is by far the better financial decision.

Invest in what you know

Peter Lynch famously said, “Invest in what you know and know why you own it.” (Oh and there are more great Peter Lynch quotes here). This is such an important principle within investing. If you are competent in the consumer staples sector, stay in the consumer staples sector.

At times you may see technology stocks return far more than your sector, but you could have easily invested in a technology company that went bust. You don’t know the industry so how would you know what’s good and what isn’t.

By sticking with an industry that you are knowledgeable about, you increase your chances of success.

Contribute regularly

Contributing at regular intervals does two things.

One, you’re saving and investing more, which increases the size of your nest egg.

Two, when the market ebbs and flows, you will continue to invest the same amount each month/year. You’ll buy more when it’s low and buy less when it’s high.

This is called dollar cost averaging. It effectively reduces your cost basis for your entire position, which effectively increases your gain, if your investment is up when you sell it.

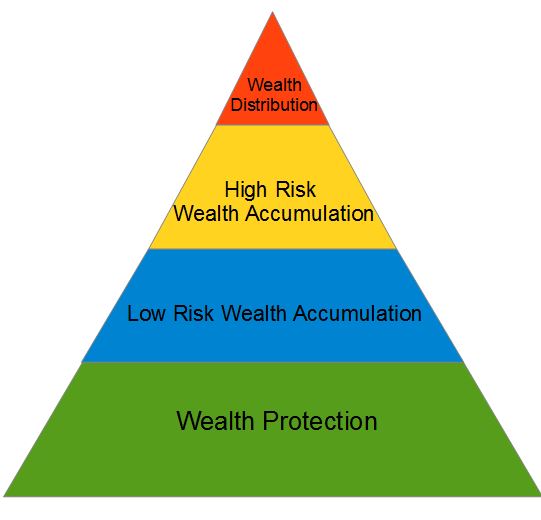

Diversify

One of the most effective ways to reduce how much your portfolio reacts to dramatic shifts in the market is to diversify. Hold some stocks, some bonds, some cash, some gold, and some real estate. There are other investment products you could own, but these are usually the big ones.

Be objective

Try to take your emotions completely out of it.

When the market starts to sell off, you need to objectively look at your positions. Look at the characteristics of the business. Has anything changed? Or is it just declining due to a broader market selloff?

If it’s the latter, take some of that cash you have and buy that baby at a discount.

Use stocks

Over the long-term, stocks are the best investment to a) outpace inflation and b) effectively appreciate the money that you’ve saved.

Utilize various products

There are a variety of vehicles out there for your investments. Take advantage of as many as you can.

A 401(k) is an employer-sponsored retirement plan. Money saved in it can lower your taxable income and investments grow tax-deferred.

Traditional IRA – Individual retirement account. You open it up and save in it. Tax-deductible contributions. Investments grow tax-deferred.

Roth IRA – Similar to a Traditional IRA, except money contributed is not tax deductible, but money withdrawn is tax-free (money withdrawn from 401k and IRA is taxed).

These are just a few of the vehicles that can be used to save for retirement.

Next week I will dive deeper into the various products available.

Say no to penny stocks

These are stocks that cost less than $5 per share. More often than not, these are very risky and the companies themselves have a much higher probability of going out of business than other companies with higher stock prices.

Don’t invest via “hot tips”

Your friend says, “A stock I invested in last week is already up 100%, you need to get in on this before it goes any higher.”

When you hear this, just let it filter out of your brain. Odds are, the dramatic increase in price is pure behavior related, and no stock can sustain that kind of growth. That stock will come crumbling down at some point.

Think of the tech bubble from the 2000s. There were companies with literally no information about them, and they were going from $10/share to $200/share within a matter of weeks.

Just 48% of companies from the dot-com bubble survived past 2004. (Source)

Conclusion

Investing for the long-term is your greatest chance for financial success. Starting early, contributing regularly, and ignoring the noise are only a few great tips discussed here, but they are probably the most important.

If you would like to hear more about long-term investing and/or for our disclosures visit www.crgfinancialservices.com.

Rates of return are hypothetical, are provided for illustrative purposes only, and do not reflect the performance of an actual investment. All investments involve the risk of potential investment losses and no strategy can assure a profit. Past performance does not guarantee future results. Diversification seeks to reduce the volatility of a portfolio by investing in a variety of asset classes. Neither asset allocation nor diversification guarantee against market loss or greater or more consistent returns.

My name is Jacob Sensiba and I am a Financial Advisor. My areas of expertise include, but are not limited to, retirement planning, budgets, and wealth management. Please feel free to contact me at: jacob@crgfinancialservices.com