Wealth transfer isn’t just about passing on assets; it’s about leaving a legacy that benefits your heirs for generations to come. While estate planning can seem daunting, there are several savvy strategies that can maximize the value of your estate and ensure your heirs are well taken care of. These hacks go beyond traditional methods and can make a significant difference in how your wealth is preserved and distributed. Here are ten genius wealth transfer hacks that will make your heirs thank you forever.

1. Start Early

One of the most effective wealth transfer hacks is to start planning early. The earlier you begin, the more options you have for optimizing your estate plan, minimizing taxes, and maximizing the growth of your assets over time.

2. Establish a Trust

Trusts are powerful tools for wealth transfer because they allow you to specify how and when your assets will be distributed to your heirs. By establishing a trust, you can protect your assets from probate, minimize estate taxes, and ensure that your wishes are carried out exactly as you intended.

3. Leverage Life Insurance

Life insurance can be a valuable tool for wealth transfer, providing a tax-free payout to your beneficiaries upon your death. By purchasing a life insurance policy, you can ensure that your heirs receive a financial cushion to help cover expenses or pay off debts without depleting your estate.

4. Gift Assets Strategically

Rather than waiting until you pass away to transfer assets to your heirs, consider gifting assets strategically during your lifetime. By taking advantage of the annual gift tax exclusion and lifetime gift tax exemption, you can transfer wealth tax-efficiently while reducing the size of your taxable estate.

5. Utilize Family Limited Partnerships

Family limited partnerships (FLPs) allow you to transfer assets to your heirs while retaining control over those assets during your lifetime. By gifting limited partnership interests to family members, you can transfer wealth at a discounted value for estate tax purposes, ultimately reducing the tax burden on your estate.

6. Implement a Grantor Retained Annuity Trust (GRAT)

A GRAT is an irrevocable trust that allows you to transfer assets to your heirs with minimal gift tax consequences. By transferring assets into a GRAT and retaining the right to receive annuity payments for a specified period, you can transfer wealth to your heirs tax-efficiently while potentially avoiding gift and estate taxes altogether.

7. Make Charitable Contributions

Charitable giving can be an effective wealth transfer strategy, allowing you to support causes you care about while reducing the size of your taxable estate. By making charitable contributions during your lifetime or through your estate plan, you can leave a lasting impact on your community while minimizing estate taxes.

8. Maximize Retirement Accounts

Retirement accounts such as IRAs and 401(k)s can be valuable assets for wealth transfer, but they come with complex tax implications. By carefully planning how and when you withdraw funds from these accounts and designating beneficiaries strategically, you can minimize taxes and maximize the value of these assets for your heirs.

9. Consider Generation-Skipping Trusts

Generation-skipping trusts (GSTs) allow you to transfer assets to beneficiaries who are two or more generations below you, such as your grandchildren, without incurring generation-skipping transfer taxes. By leveraging GSTs, you can preserve wealth for future generations while minimizing tax consequences. However, GSTs are most effective for higher net-worth families.

10. Educate Your Heirs

Finally, one of the most valuable wealth transfer hacks is to educate your heirs about financial literacy and responsible wealth management. By providing them with the knowledge and skills they need to manage their inheritance wisely, you can ensure that your wealth has a lasting and positive impact on their lives.

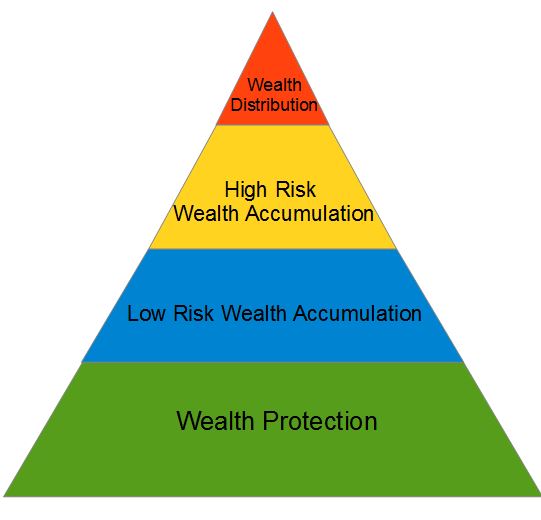

Transferring Wealth Strategically

Wealth transfer is a complex process that requires careful planning and consideration. By implementing these ten genius wealth transfer hacks, you can optimize your estate plan, minimize taxes, and ensure that your heirs are well-positioned to thrive for generations to come. Whether you’re just beginning to plan your estate or looking to fine-tune your existing plan, these hacks offer valuable strategies for maximizing the value of your wealth and leaving a lasting legacy for your heirs.

Read More

14 Online Behaviors That Put You at Risk of Cybercrime

10 Unnecessary Dental Procedures Your Dentist May Be Charging You For