Image Source: pexels.com

Life has a way of throwing curveballs when you least expect it. One day, everything’s running smoothly, and the next, your car breaks down, your job is on the line, or a medical bill lands in your mailbox. That’s where an emergency fund steps in—a financial safety net that can keep you afloat when the unexpected happens. But how much should you really have set aside? Many people underestimate the true amount needed, leaving themselves vulnerable when life takes a turn. Building a robust emergency fund isn’t just smart; it’s essential for financial peace of mind. Let’s break down exactly how much you need—and why it’s probably more than you think.

1. Start With the Basics: Three to Six Months of Expenses

The classic rule of thumb for an emergency fund is to save enough to cover three to six months of living expenses. This isn’t just rent or mortgage payments—it includes groceries, utilities, insurance, transportation, and any other recurring bills. The idea is simple: if you lose your job or face a major setback, you’ll have a cushion to keep you going while you get back on your feet. For most people, this means calculating their total monthly expenses and multiplying by three or six. If your monthly expenses are $3,000, you’re looking at $9,000 to $18,000. This range isn’t arbitrary; it’s based on how long it typically takes to find new employment or recover from a financial shock.

2. Factor in Your Job Stability

Not all jobs are created equal when it comes to security. You’ll want a larger emergency fund if you work in a volatile industry, are self-employed, or rely on freelance gigs. Unpredictable income means you could go longer between paychecks, so a six-month cushion might not be enough. On the other hand, if you have a stable government job or work in a high-demand field, you might feel comfortable with a smaller fund. Still, erring on the side of caution is wise. Job markets can shift quickly, and layoffs can happen even in “safe” industries. Assess your own risk and adjust your emergency fund target accordingly.

3. Don’t Forget About Health and Family Needs

Medical emergencies are one of the top reasons people dip into their emergency funds. Even with insurance, deductibles and out-of-pocket costs can add up fast. Your emergency fund should reflect those extra responsibilities if you have dependents—kids, aging parents, or anyone else relying on your income. Think about potential medical expenses, childcare, or even the cost of taking unpaid leave to care for a loved one. The more people who depend on you, the more you’ll need to set aside.

4. Consider Your Debt Obligations

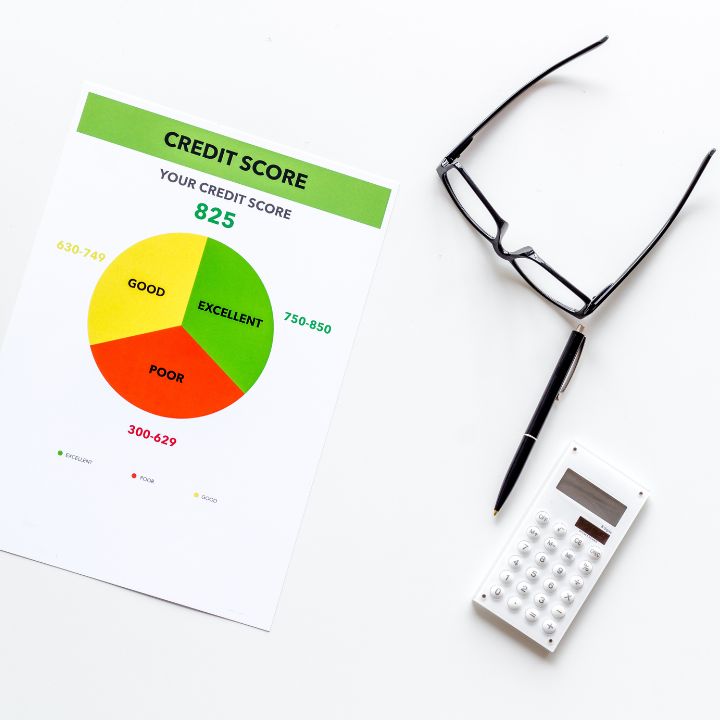

Debt doesn’t take a break just because you’re facing an emergency. Credit card payments, student loans, and car loans all keep coming, no matter what. If you have significant debt, your emergency fund should be large enough to cover those minimum payments for several months. This prevents you from falling behind, damaging your credit score, or racking up late fees. When calculating your emergency fund, add up all your monthly debt payments and include them in your total. This way, you’re truly protected from financial fallout.

5. Plan for the “Hidden” Emergencies

Not all emergencies are dramatic or obvious. Sometimes, it’s the small, unexpected expenses that catch you off guard—a broken appliance, a surprise vet bill, or a sudden move. These “hidden” emergencies can drain your savings if you’re not prepared. Building a little extra into your emergency fund for these smaller, less predictable costs can save you from dipping into your regular savings or going into debt. Think of it as a buffer on top of your main emergency fund target.

6. Adjust for Inflation and Life Changes

Your emergency fund isn’t a set-it-and-forget-it account. As your life changes—new job, new home, growing family—your expenses will shift. Inflation also means that what was enough a few years ago might not cut it today. Review your emergency fund at least once a year and adjust the amount as needed. If your expenses go up, so should your savings goal. Staying proactive ensures your emergency fund keeps pace with your real-life needs.

7. Where to Keep Your Emergency Fund

Accessibility is key when it comes to emergency funds. You want your money somewhere safe, but also easy to access in a pinch. High-yield savings accounts or money market accounts are popular choices because they offer better interest rates than traditional savings accounts while keeping your funds liquid. Avoid tying up your emergency fund in investments that could lose value or take time to access, like stocks or retirement accounts. The goal is to have cash ready when you need it, not to chase higher returns.

Rethink What “Enough” Really Means

Building an emergency fund is about more than just hitting a number—it’s about creating real financial security for yourself and your loved ones. The right amount is different for everyone, but it’s almost always more than you initially think. By considering your unique situation—job stability, family needs, debt, and the unexpected—you can set a target that truly protects you. Don’t settle for the bare minimum. Give yourself the peace of mind that comes from knowing you’re ready for whatever life throws your way.

How much do you keep in your emergency fund, and has it ever saved you from a financial crisis? Share your story in the comments!

Read More

Find the Right Amount of Life Insurance in 10 Minutes

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.