Image Source: pexels.com

Building real wealth isn’t just about how much you earn—it’s about how you manage what you have. Many people fall into the trap of financing things that drain their resources and keep them from reaching true financial freedom. If you want to break the cycle of living paycheck to paycheck and start building real wealth, it’s crucial to know which purchases are best left out of your financing plans. By avoiding these common pitfalls, you’ll keep more of your hard-earned money and set yourself up for a future where your finances work for you, not against you. Let’s dive into the things you should never finance if you want real wealth.

1. New Cars

Financing a brand-new car is one of the fastest ways to lose money. The moment you drive a new car off the lot, it loses up to 20% of its value, and it continues to depreciate rapidly over the next few years. When you finance a new car, you’re not just paying for the vehicle—you’re also paying interest on a depreciating asset. This means you could end up owing more than the car is worth, a situation known as being “upside down” on your loan. Instead, consider buying a reliable used car with cash or a minimal loan. This approach keeps your monthly expenses low and helps you build real wealth by avoiding unnecessary debt.

2. Vacations

Everyone loves a good getaway, but financing a vacation is a surefire way to sabotage your financial goals. When you put a trip on your credit card or take out a personal loan to fund your travels, you’re essentially paying extra for memories that could have been just as sweet if you’d saved up in advance. The interest you pay on financed vacations can linger long after your tan fades, making it harder to achieve real wealth. Instead, set up a dedicated savings account for travel and only book trips you can afford to pay for in cash. This way, you’ll enjoy your vacation without the stress of debt following you home.

3. Designer Clothes and Accessories

It’s tempting to want the latest fashion or luxury accessories, but financing these purchases is a quick way to derail your path to real wealth. High-end clothing and accessories rarely retain their value, and trends change rapidly. Using credit to buy these items means you’re paying interest on something that will likely be out of style or worn out before you’ve even finished paying it off. Focus on building a versatile wardrobe with quality basics that you can afford, and save splurges for special occasions when you have the funds available.

4. Weddings

Weddings are special, but financing a lavish celebration can leave you and your partner starting your new life together in debt. The average cost of a wedding in the U.S. is over $30,000, and many couples take out loans or rack up credit card debt to cover the expenses. This financial burden can put unnecessary strain on your marriage and delay your journey toward real wealth. Instead, prioritize what truly matters to you, set a realistic budget, and explore creative ways to celebrate without overspending.

5. Everyday Expenses

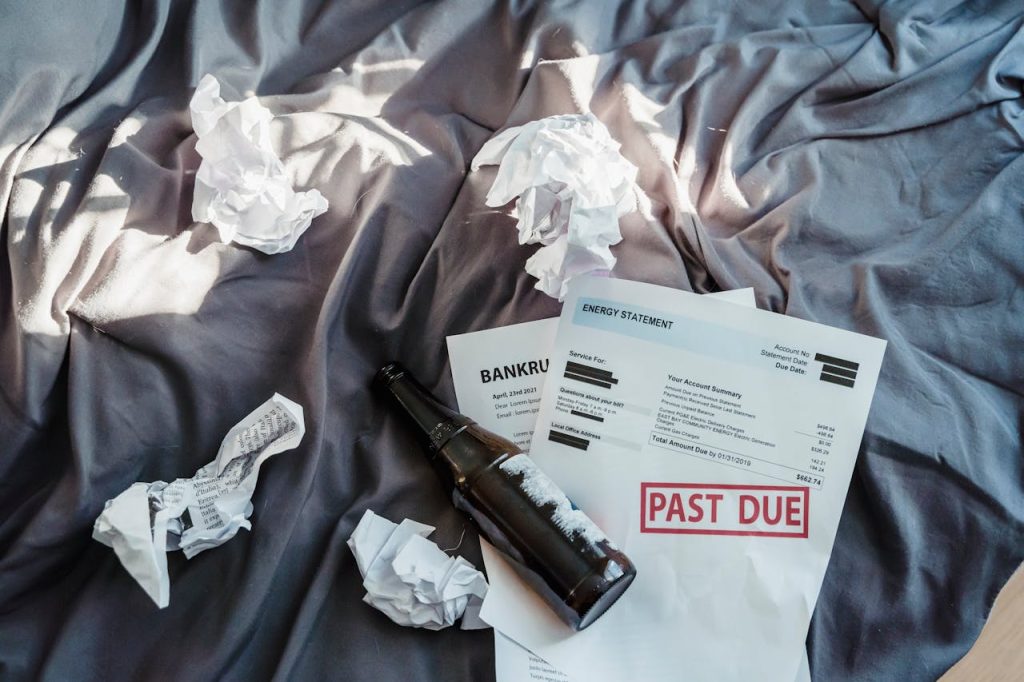

Using credit to cover everyday expenses like groceries, gas, or utility bills is a red flag that your budget needs attention. Financing these recurring costs can quickly spiral into a cycle of debt that’s hard to escape. Interest charges add up, making it even more difficult to get ahead. If you find yourself relying on credit for basics, it’s time to reassess your spending and look for ways to cut back. Building real wealth starts with living within your means and using credit only for emergencies or planned, manageable purchases.

6. Electronics and Gadgets

The latest phone, laptop, or smart device can be tempting, but financing electronics is rarely a wise move. Technology evolves quickly, and what’s cutting-edge today will be outdated in a year or two. When you finance gadgets, you’re often locked into high-interest payment plans or store credit cards, which can eat away at your ability to build real wealth. Instead, save up for tech upgrades and only buy what you truly need. This habit keeps your finances healthy and ensures you’re not paying extra for fleeting trends.

7. Furniture and Home Decor

It’s easy to get swept up in the excitement of furnishing a new home, but financing furniture and decor can lead to years of payments on items that quickly lose value. Many stores offer “no interest” deals, but these often come with hidden fees or deferred interest that can catch you off guard. To build real wealth, focus on acquiring high-quality pieces over time, as your budget allows. Thrift stores, online marketplaces, and DIY projects can help you create a comfortable home without the burden of debt.

Building Real Wealth Means Saying No to Unnecessary Debt

The path to real wealth is paved with smart decisions and disciplined spending. By refusing to finance depreciating assets and non-essential purchases, you free up your income to invest, save, and grow your net worth. Every dollar you don’t spend on interest is a dollar you can put toward your future. Remember, real wealth isn’t about having the most stuff—it’s about having the freedom and security to live life on your terms.

What’s one thing you regret financing, or what’s your best tip for avoiding unnecessary debt? Share your thoughts in the comments!

Read More

Stop Reading About Last Year’s Top Ten Mutual Funds

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.