Image Source: pexels.com

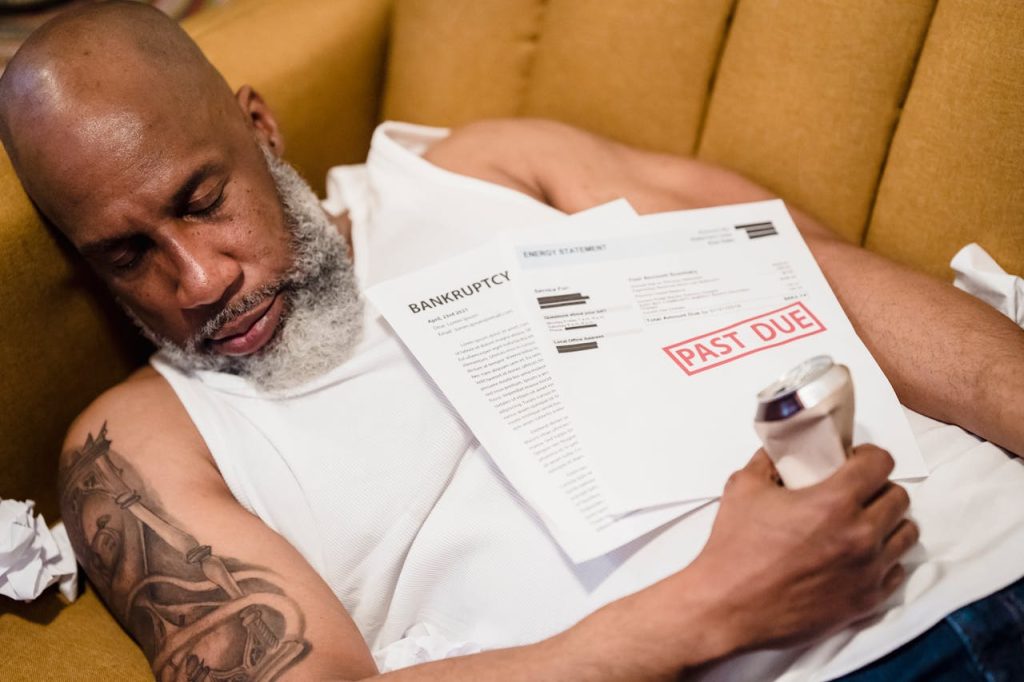

Debt can feel like a heavy weight. Many people look for a way out, and debt relief programs often seem like a lifeline. But not all programs are created equal. One debt relief program is now facing federal scrutiny, raising questions about its practices and promises. If you’re thinking about using a debt relief program, or you’re already enrolled in one, this news matters. Here’s what you need to know and what you can do to protect yourself.

1. What Is a Debt Relief Program?

A debt relief program is a service that claims to help you reduce or eliminate your unsecured debts. These programs often target people struggling with credit card bills, medical debt, or personal loans. The idea is simple: you pay the program, and they negotiate with your creditors. Sometimes, they promise to settle your debt for less than you owe. But the process isn’t always straightforward. Some programs charge high fees or make promises they can’t keep. And now, one major debt relief program is under federal scrutiny, which means regulators are looking closely at how it operates.

2. Why Is This Debt Relief Program Facing Federal Scrutiny?

Federal agencies step in when they see signs of unfair or deceptive practices. In this case, the debt relief program in question is being investigated for how it advertises its services and handles client money. There are concerns about misleading claims, hidden fees, and whether the program actually delivers on its promises. When a debt relief program faces federal scrutiny, it’s a sign that something may be wrong. This can lead to lawsuits, fines, or even the shutdown of the program. If you’re enrolled in a debt relief program, this kind of news should make you pause and review your options.

3. How Does Federal Scrutiny Affect You?

If you’re using a debt relief program that’s under investigation, you could be at risk. Your payments might not go where you expect. You could end up with more debt, not less. Some people have found that their credit scores drop or that they get sued by creditors while waiting for the program to work. Federal scrutiny can also mean delays or changes in how the program operates. You might get less support, or the company could stop communicating. It’s important to stay alert and keep records of every payment and conversation.

4. What Should You Watch Out For?

Not all debt relief programs are bad, but some use tactics that can hurt you. Watch for red flags like upfront fees, guarantees to erase your debt, or pressure to stop paying your creditors. If a debt relief program promises results that sound too good to be true, be careful. Read every contract before you sign. Ask questions about fees, timelines, and what happens if negotiations fail. If you don’t get clear answers, walk away. Remember, a debt relief program should help you, not make things worse.

5. What Are Your Alternatives?

If you’re worried about a debt relief program under federal scrutiny, you have other options. You can talk to a nonprofit credit counseling agency. These agencies can help you make a budget, negotiate lower interest rates, or set up a debt management plan. You can also try to negotiate directly with your creditors. Sometimes, they’ll work with you if you explain your situation. Bankruptcy is another option, but it’s a big step with long-term effects. The key is to look at all your choices before you commit to any debt relief program.

6. How Can You Protect Yourself?

Protecting yourself starts with research. Check if the debt relief program is registered in your state. Look for reviews and complaints online. Ask for everything in writing. Don’t pay large fees upfront. If you feel pressured, take a step back. You have the right to ask questions and get honest answers. If you think you’ve been misled, report it to the authorities. Staying informed is your best defense against a debt relief program that’s facing federal scrutiny.

7. What Steps Should You Take If You’re Already Enrolled?

If you’re already in a debt relief program that’s under investigation, don’t panic. Start by reviewing your contract and payment history. Contact the company and ask about the investigation. If you don’t get clear answers, consider stopping payments until you know more. Reach out to your creditors to explain the situation. They may be willing to work with you directly. Keep copies of all your communications. If you need help, talk to a financial advisor or a legal aid service. Taking action now can help you avoid bigger problems later.

Staying Ahead of Debt Relief Program Risks

Federal scrutiny of a debt relief program is a warning sign. It means you need to pay attention, ask questions, and protect your finances. Not every debt relief program is a scam, but you can’t afford to take chances with your money or your future. Stay informed, know your rights, and don’t be afraid to seek help if something feels off. The right steps now can save you from bigger headaches down the road.

Have you ever used a debt relief program? What was your experience? Share your story in the comments.

Read More

How Revealing Your Debt Online Can Lead to Accountability

10 Debt Payoff Plans That Work Faster Than You Think

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.