Image Source: pexels.com

Millennials are now filing more bankruptcy cases than Baby Boomers, and it’s not just a headline. This shift matters because it signals deeper changes in how younger adults handle debt, jobs, and money stress. If you’re a Millennial, you might see yourself in these stories. If you’re a Boomer, you might wonder what’s changed. Either way, understanding why this is happening can help you make better choices with your own finances. Bankruptcy isn’t just a legal process—it’s a sign of bigger trends in the economy and society. Here’s what’s really going on.

1. Student Loan Debt Is Crushing Millennials

Student loan debt is one of the biggest reasons Millennials are filing more bankruptcy cases than Boomers. Many Millennials left college with tens of thousands of dollars in loans. Unlike Boomers, who often paid much less for college, Millennials face monthly payments that can last decades. This debt makes it hard to save, buy a home, or even pay for emergencies. When a job loss or medical bill hits, bankruptcy can feel like the only way out. The numbers back this up: student loan debt in the U.S. has reached over $1.7 trillion, and Millennials hold a big share of it.

2. Wages Haven’t Kept Up with Living Costs

Millennials are earning more in dollars than Boomers did at the same age, but it doesn’t go as far. Rent, groceries, and health care have all gone up faster than paychecks. Many Millennials work multiple jobs or side gigs just to cover the basics. When expenses outpace income, debt piles up. Credit cards, personal loans, and buy-now-pay-later plans fill the gap, but they also add risk. If something goes wrong, like a layoff or illness, it’s easy to fall behind. Bankruptcy becomes a way to reset, but it’s a sign that the system isn’t working for everyone.

3. Medical Debt Hits Millennials Hard

Health insurance is expensive, and many Millennials don’t have enough coverage. Even with insurance, high deductibles and out-of-pocket costs can lead to big bills. One trip to the ER or a short hospital stay can mean thousands in debt. Medical debt is now a leading cause of bankruptcy for Millennials. Boomers often had better employer coverage or lower costs when they were younger. For Millennials, a single health crisis can wipe out savings and push them toward bankruptcy court.

4. The Gig Economy Brings Instability

Many Millennials work in the gig economy—think rideshare drivers, freelancers, or delivery workers. These jobs offer flexibility but little security. There’s no paid sick leave, no retirement plan, and income can change week to week. When work dries up, bills don’t stop. This instability makes it hard to plan or save for the future. If a car breaks down or a client doesn’t pay, debt can spiral fast. Bankruptcy becomes a last resort for many who just can’t keep up.

5. Housing Costs Are Out of Reach

Home prices and rents have soared in many cities. Millennials are less likely to own homes than Boomers were at the same age. Many spend a big chunk of their income on rent, leaving little for savings or emergencies. When rent eats up half your paycheck, it’s easy to fall behind on other bills. Some Millennials use credit cards to cover rent or move in with roommates to make ends meet. But if something goes wrong, like a rent hike or job loss, bankruptcy can follow.

6. Credit Is Easier—And Riskier—to Get

Credit cards, personal loans, and online lenders are everywhere. It’s easy for Millennials to get approved, even with average credit. But high interest rates and fees can trap people in a cycle of debt. Many Millennials use credit to cover basic needs, not just extras. When balances grow and payments get missed, late fees and penalties add up. Bankruptcy can wipe the slate clean, but it also shows how easy credit can turn into a problem.

7. Financial Literacy Gaps

Many Millennials never learned the basics of budgeting, saving, or managing debt. Schools often skip personal finance, and parents may not have taught these skills. Without a strong foundation, it’s easy to make mistakes, like taking on too much debt or not saving for emergencies. Some Millennials turn to social media for advice, but not all tips are good ones. When things go wrong, bankruptcy can seem like the only option left.

8. Social Pressures and Lifestyle Inflation

Social media shows a highlight reel of vacations, new cars, and fancy dinners. It’s easy to feel pressure to keep up, even if it means spending money you don’t have. Some Millennials take on debt to match their friends’ lifestyles. Over time, this “lifestyle inflation” can lead to big bills and little savings. When the bills come due, and there’s no way to pay, bankruptcy can follow.

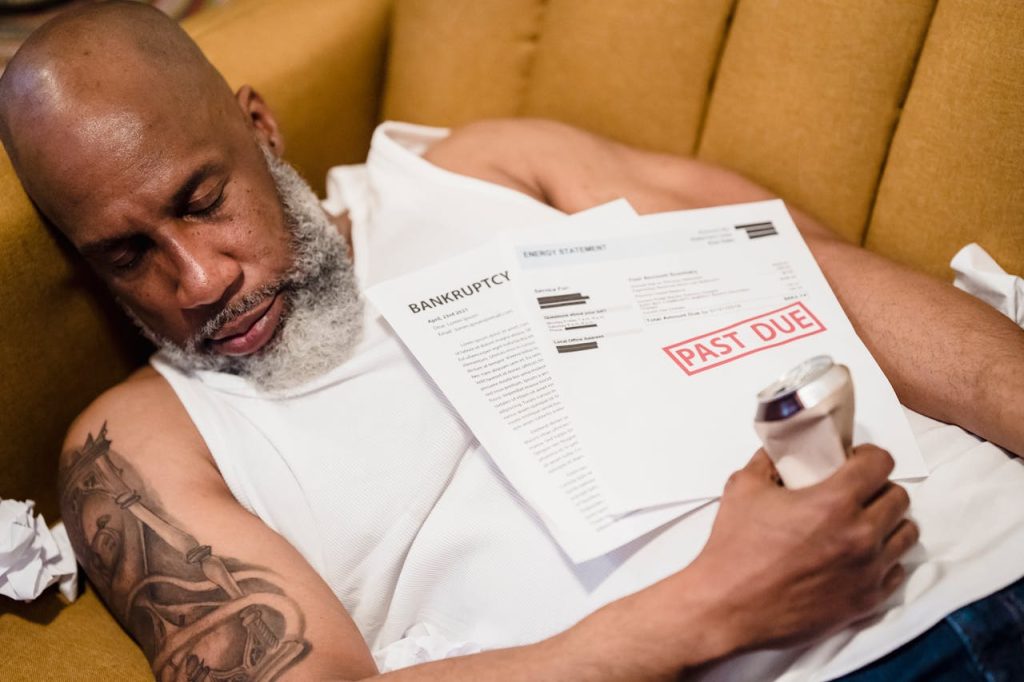

9. The Pandemic’s Lasting Impact

COVID-19 hit Millennials hard. Many lost jobs, faced pay cuts, or had to care for family members. Savings disappeared fast, and debt grew. Even as the economy recovers, some Millennials are still catching up. The pandemic exposed how little of a safety net many had. For some, bankruptcy was the only way to start over.

A New Financial Reality for Millennials

Millennials are filing more bankruptcy cases than Boomers because the world has changed. Student loans, high living costs, unstable jobs, and easy credit all play a part. But it’s not just about numbers—it’s about how people live and work today. If you’re struggling, you’re not alone. There are ways to get help, from credit counseling to legal aid.

Have you or someone you know faced bankruptcy? What challenges did you see, and what advice would you share? Add your thoughts in the comments.

Read More

Should You File for Bankruptcy? These Are the Telltale Signs That You Should

Your Guide to Getting Out of Debt and Starting Over

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.