Image Source: pexels.com

Life throws curveballs. You save for emergencies, thinking you’re covered. But what if your emergency fund isn’t enough? Many people believe that a few months of expenses in the bank will protect them from anything. The truth is, unexpected costs can hit harder and last longer than you think. If you want real financial security, you need to look beyond the basics. Here’s why your emergency fund may not be enough—and what you can do about it.

1. Emergencies Can Last Longer Than You Expect

Most people aim for three to six months of expenses in their emergency fund. That sounds reasonable. But what if you lose your job and it takes a year to find another one? Or what if a medical issue keeps you out of work for months? The average job search in the U.S. can last over five months, and some industries take even longer. If your emergency fund only covers a few months, you could run out of money before you’re back on your feet. It’s smart to plan for the possibility that your emergency will last longer than you hope.

2. Inflation Eats Away at Your Savings

Prices go up. That’s a fact. If you set aside your emergency fund and don’t touch it for years, inflation can shrink its value. What covered six months of expenses five years ago might only cover four months today. This is especially true for costs like rent, groceries, and healthcare, which often rise faster than general inflation. To keep your emergency fund strong, review it every year. Adjust the amount to match your current expenses, not what you spent in the past.

3. Medical Costs Can Be Much Higher Than You Think

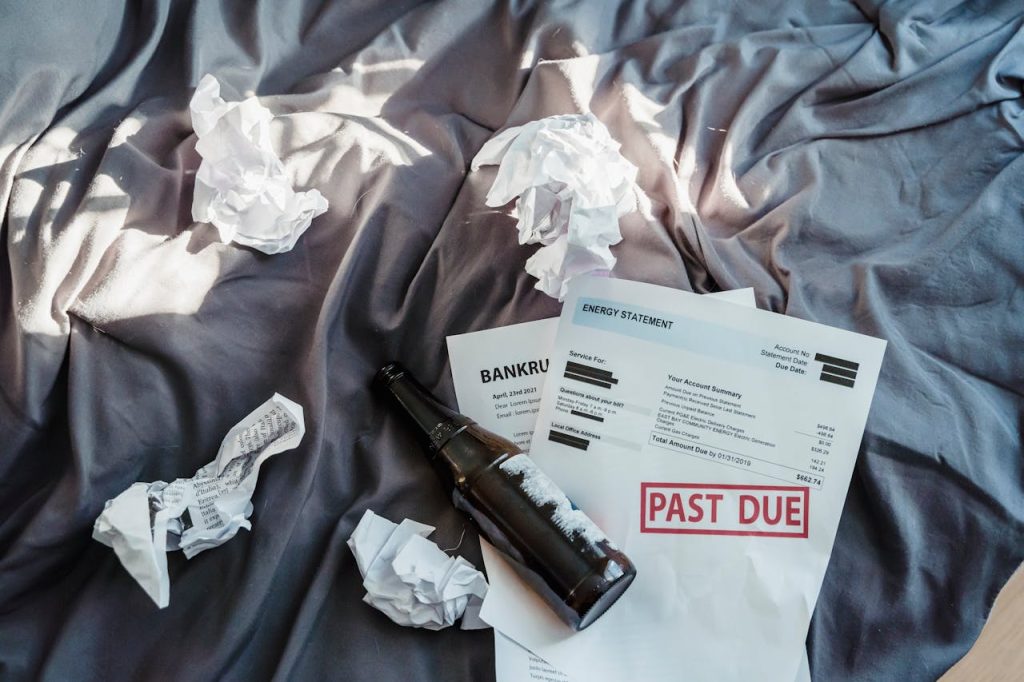

A trip to the emergency room or a hospital stay can wipe out your savings fast. Even with insurance, deductibles, copays, and out-of-network charges add up. Some treatments or medications aren’t covered at all. Medical debt is a leading cause of bankruptcy in the U.S. If your emergency fund is based only on your regular monthly expenses, it may not be enough to handle a big medical bill. Consider setting aside extra for health emergencies, especially if you have a high-deductible plan or chronic health issues.

4. Unexpected Expenses Go Beyond the Obvious

You probably think of job loss, car repairs, or medical bills when you hear “emergency fund.” But what about legal fees, family emergencies, or sudden moves? Maybe your pet needs surgery. Maybe you have to travel for a funeral. These costs can be huge and come out of nowhere. If your emergency fund only covers the basics, you might not be ready for the full range of surprises life can throw at you. Think about the less obvious risks in your life and plan for them.

5. Insurance Gaps Can Leave You Exposed

Insurance helps, but it doesn’t cover everything. Homeowners insurance may not pay for flood damage. Health insurance might not cover every treatment. Car insurance has limits and deductibles. If you rely on insurance alone, you could face big out-of-pocket costs. Review your policies and look for gaps. Make sure your emergency fund can handle what insurance won’t pay.

6. Family and Friends May Need Your Help

Sometimes, the emergency isn’t yours. A family member loses their job. A friend faces eviction. You want to help, and sometimes you have to. If your emergency fund only covers your own needs, you may not have enough to support others when it matters. Think about the people who rely on you. If you have kids, aging parents, or close friends who might need help, factor that into your savings plan.

7. Your Income May Not Bounce Back Right Away

After an emergency, you might expect things to return to normal quickly. But sometimes, your income takes a hit and stays low for a while. Maybe you have to take a lower-paying job. Maybe your business slows down. If your emergency fund is based on your old income, it might not stretch as far as you need. Plan for a slower recovery. Build a buffer that gives you time to adjust if your income drops for the long term.

8. Debt Can Make Emergencies Worse

If you have debt, an emergency can push you deeper into the hole. You might have to use credit cards or take out loans to cover costs your emergency fund can’t handle. This adds interest and stress. If your emergency fund isn’t big enough, you risk trading one problem for another. Try to keep your debt low and your emergency fund high. That way, you’re less likely to rely on borrowing when things go wrong.

9. Natural Disasters and Major Events Are Unpredictable

Floods, fires, hurricanes, and other disasters can destroy homes and disrupt lives. These events often cost more than you expect and can take months or years to recover from. Insurance helps, but it rarely covers everything. If you live in an area prone to disasters, your emergency fund needs to be bigger. Think about what it would take to rebuild your life, not just pay the bills for a few months.

Building True Financial Security

An emergency fund is a good start, but it’s not a guarantee. Emergencies are unpredictable, and costs can spiral fast. Review your emergency fund every year. Adjust for inflation, new risks, and changes in your life. Think beyond the basics—plan for the unexpected, not just the likely. True financial security means being ready for anything, not just the obvious.

How has your emergency fund helped you—or fallen short—when you needed it most? Share your story in the comments.

Read More

Find the Right Amount of Life Insurance in 10 Minutes

Is Disability Insurance Optional? I Think Not – Our Boner of the Week

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.