Image Source: pexels.com

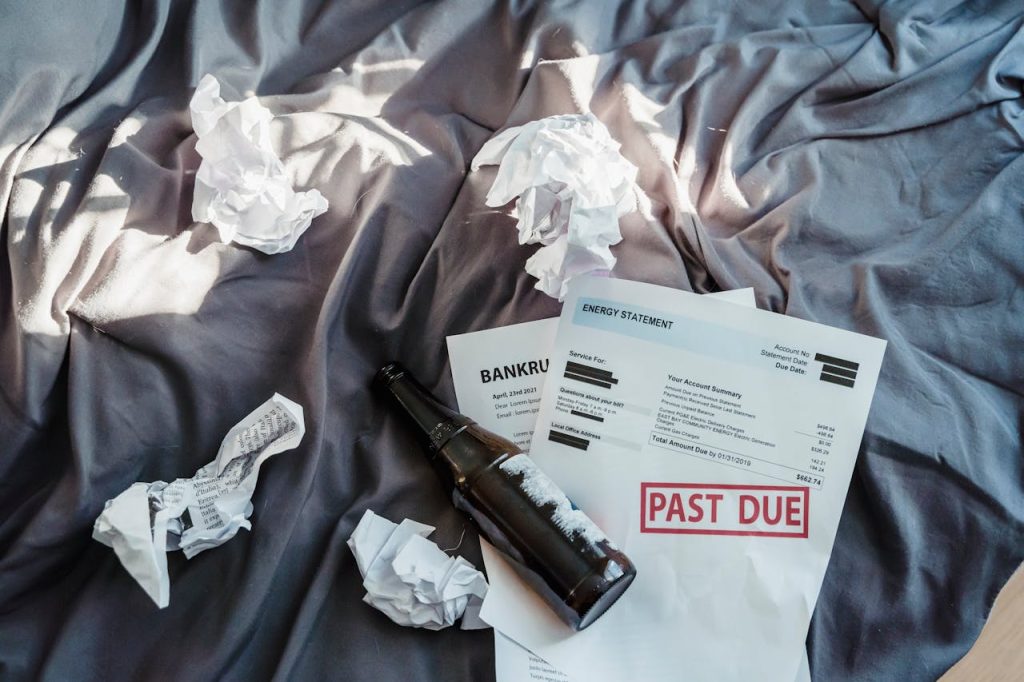

Debt is a reality for millions of Americans, shaping everything from daily choices to long-term dreams. For many, debt isn’t just a number on a statement—it’s a source of stress, a barrier to opportunity, and a constant worry about the future. Yet, the way debt impacts everyday people is worlds apart from how the wealthy experience it. Understanding these differences isn’t just eye-opening; it’s essential for making smarter financial decisions and protecting your future. If you’ve ever wondered why debt feels like a trap for some but a tool for others, you’re not alone. The unsettling truths about debt that rich people don’t face can help you see your own situation more clearly—and take action to change it.

1. Debt Is More Expensive for the Average Person

The cost of debt isn’t just about the amount you owe—it’s about the interest rates you pay. For most Americans, especially those with average or below-average credit, borrowing money comes with steep costs. The Federal Reserve reports that the U.S.’s average credit card interest rate now exceeds 20%, while payday loans can carry annual percentage rates (APRs) of 400% or more. In contrast, wealthy individuals often access loans with single-digit interest rates, thanks to strong credit scores and valuable collateral.

This difference means that a $5,000 credit card balance can cost a middle-class borrower hundreds of dollars in interest each year, while a wealthy borrower might pay a fraction for a much larger loan. Over time, these higher costs make it harder to pay down debt, trapping many in a cycle of minimum payments and mounting balances. If you’re struggling with high-interest debt, consider options like balance transfers, credit counseling, or negotiating lower rates to reduce the long-term burden.

2. Debt Limits Opportunity for Most, But Not for the Wealthy

For many, debt isn’t just a financial obligation—it’s a barrier to opportunity. Student loan debt, for example, now totals over $1.7 trillion in the U.S., with the average borrower owing more than $37,000. This burden can delay major life milestones like buying a home, starting a family, or saving for retirement. A 2023 Pew Research Center study found that 22% of young adults with student debt have postponed marriage or having children due to their financial situation.

On the other hand, wealthy individuals often use debt strategically to build wealth—borrowing against assets to invest in businesses, real estate, or the stock market. They have access to financial advisors and flexible credit lines that allow them to leverage debt for growth, not just survival. For most people, though, debt means fewer choices and more stress. If debt is holding you back, focus on building an emergency fund and paying down high-interest balances first, so you can regain control over your financial future.

3. The Safety Net Is Thinner for Regular Borrowers

When financial setbacks hit, the consequences of debt can be severe for the average person. Missed payments can lead to late fees, damaged credit scores, and even wage garnishment. The Consumer Financial Protection Bureau notes that nearly 28% of Americans with a credit record have at least one debt in collections. A single emergency—like a medical bill or car repair—can trigger a downward spiral for those living paycheck to paycheck.

Rich people, by contrast, have resources to cushion the blow. They can sell assets, tap into savings, or restructure loans with favorable terms. Even in bankruptcy, wealthy individuals often retain significant assets through legal protections. For most, though, the margin for error is razor-thin. To protect yourself, build a small emergency fund—even $500 can make a difference—and seek out community resources or nonprofit credit counseling if you’re struggling to keep up.

4. Credit Access Is Unequal—and It Matters

Access to affordable credit is a privilege, not a guarantee. Lenders use credit scores, income, and assets to determine who gets the best rates and terms. A 2024 Experian report shows that the average credit score in the U.S. is 715, but scores below 670 are considered subprime, leading to higher costs and fewer options. This system disproportionately affects people of color and those from lower-income backgrounds, who are more likely to face higher rates or outright denial.

Wealthy borrowers, meanwhile, often have established relationships with banks and can negotiate custom loan terms. They may even use “asset-based lending,” where their investments serve as collateral, unlocking low-cost credit unavailable to most. If you’re working to improve your credit, start by checking your credit report for errors, paying bills on time, and keeping credit card balances low. Over time, these steps can open doors to better financial opportunities.

5. The Emotional Toll of Debt Is Heavier for Most People

Debt isn’t just a financial issue—it’s an emotional one. Surveys from the American Psychological Association consistently show that money is the top source of stress for Americans, with debt playing a major role. Anxiety, sleeplessness, and even depression are common among those struggling to keep up with payments. The wealthy, insulated by assets and access, rarely face the same level of day-to-day worry.

This emotional burden can affect relationships, job performance, and overall well-being. If debt stress is impacting your life, don’t hesitate to seek support from friends, family, or a mental health professional. Remember, you’re not alone, and taking small steps toward managing debt can help restore peace of mind.

Rethinking Debt: What You Can Do Differently

The unsettling truths about debt that rich people don’t face reveal a system stacked against the average borrower. High costs, limited opportunities, thin safety nets, unequal access, and emotional strain all combine to make debt a much heavier burden for most Americans. But knowledge is power. By understanding these differences, you can take steps to protect yourself: focus on improving your credit, build a small emergency fund, seek out lower-cost borrowing options, and don’t be afraid to ask for help.

What’s one change you could make today to lighten your debt load or reduce financial stress? Share your thoughts and experiences in the comments—your story could help someone else feel less alone.

Read More

Your Friend Makes More Money Than You? Now What? Dealing with Financial Jealousy

7 Unexpected Ways Hospitals Can Help You Slash Your Medical Debt

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.