When you’re planning for retirement, classic advice usually states to take advantage of every plan option available to you. However, while a 401K can be an asset, that doesn’t mean it’s the perfect choice for every situation. If you’re wondering if a 401K is worth it, here’s what you need to know.

The Benefits of a 401K

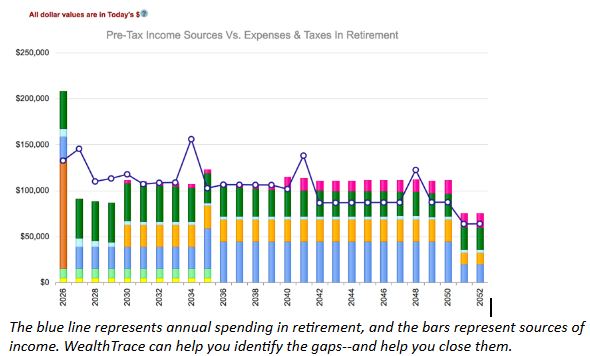

A 401K has specific benefits that can potentially make one a worthwhile addition to your retirement plan. One of the biggest is its tax-deferred status. When you start contributing, you reduce your tax burden immediately since the payments typically come from pre-tax dollars. If you earn more money now than you will in retirement, you’ll potentially come out financially ahead.

Employer matches are another benefit of a 401K. Many companies will match employee contributions up to a specific amount. By contributing enough to capture the maximum, you’re essentially collecting the most “free” money possible for retirement.

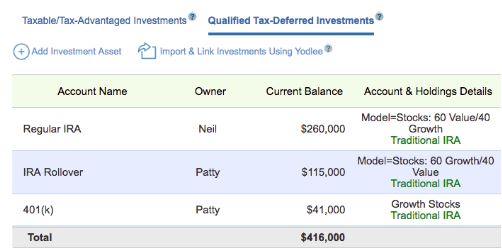

In most cases, 401Ks come with a wide array of investment options, too. This allows you to choose a portfolio mix based on your comfort with risk, values, financial goals, and other factors. Plus, there are typically several asset classes available, including stocks, ETFs, money market funds, and more.

Finally, many 401Ks allow people to borrow against the account. Essentially, your account balance acts as collateral, and you can pay the amount back with interest over time. In some cases, these loans offer more favorable rates. Plus, if you repay the full amount before changing to a new employer, it typically won’t impact your income for tax purposes.

The Drawbacks of a 401K

While 401Ks come with some notable benefits, that doesn’t mean there aren’t drawbacks to consider. As a defined contribution plan, you’ll send an amount to the plan every paycheck regardless of market conditions. While the concept of dollar-cost averaging could reduce any harm from investing at inopportune times, it does mean you’ll sometimes invest during periods that aren’t offering the best value.

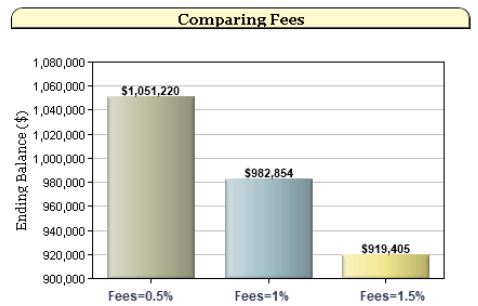

You may also have to contend with 401K fees. Precisely what that involves varies from one employer to the next, but they can add up surprisingly quickly, offsetting at least some of your earnings or actually causing you to spend more than you make during economic downturns.

It’s also important to note that some 401K plans come with surprisingly few investment options. You may have only a small number of investments to choose from, and most of what’s available may simply be mutual funds, particularly target-date funds.

Finally, while employer matches are typically one of the benefits of 401Ks, not all companies offer one. Additionally, some have very low matches, which can make a high-cost 401K a poor choice for some investors.

Is a 401K Worth It?

Generally speaking, a 401K can be worth it, suggesting you have a plan available that meets your needs. If there is a wide array of investment options, a generous employer match, and a reasonable fee structure, and you’re in a higher tax bracket now than you will be in the future, using a tax-deferred option like a 401K could be worthwhile. However, if none of that applies, there are more flexible options available, and it could be wise to explore them instead.

Do you have a 401K? If so, do you think it’s worthwhile, or do you believe that other retirement savings options are a better fit? How do you make the most of your 401K to ensure your financial future? Share your thoughts in the comments below.

Read More:

- What You Need to Know About Solo 401(k)s

- What to Do with Your Old 401k

- Can an Employer Charge Fees to Turnover Your 401(k) After You Quit a Job?

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.