Image Source: pexels.com

Divorce is a life-altering event, and for many parents, it comes with an unexpected twist: adult children moving back home. While opening your doors may feel like the right thing to do, hosting adult kids after divorce can quietly drain your finances, energy, and emotional reserves. Many parents underestimate the true impact until they’re knee-deep in bills, stress, and shifting family dynamics. If you’re navigating this new chapter, understanding the hidden costs is crucial for your financial health and peace of mind. Let’s break down what you need to know—and what you can do about it.

1. Financial Strain on a Single Income

Hosting adult kids after divorce often means supporting them on a single income. After a split, your household budget is already stretched thinner than before. Adding another adult—who may not contribute financially—can quickly lead to higher grocery bills, increased utility costs, and unexpected expenses. Even if your child promises to pitch in, the reality is that many young adults are still finding their financial footing. According to a Pew Research Center study, a record number of young adults now live with their parents, often due to economic pressures. This trend can significantly impact your ability to save for retirement or rebuild after a divorce.

2. Delayed Financial Recovery

Divorce often means starting over financially, and hosting adult kids after divorce can slow your recovery. Every dollar spent supporting your child is a dollar not going toward your emergency fund, retirement savings, or debt repayment. The longer your adult child stays, the more you may postpone important financial goals. This delay can have long-term consequences, especially if you’re nearing retirement age. It’s essential to have open and honest conversations about the duration of your support and what your child can do to achieve financial independence.

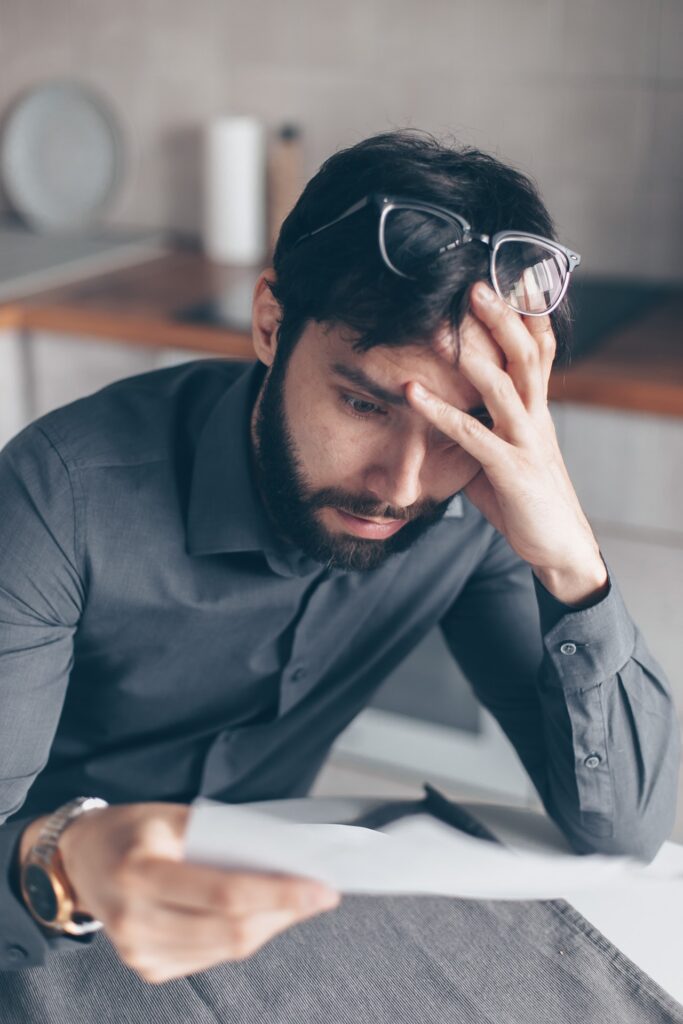

3. Emotional Toll and Boundary Challenges

The emotional cost of hosting adult kids after divorce is often overlooked. You may feel pressure to “make up” for the divorce by providing extra support, but this can lead to resentment and burnout. Living with an adult child can blur boundaries, making it hard to establish new routines or enjoy your own space. It’s common for parents to feel guilty about setting limits, but clear boundaries are essential for everyone’s well-being. Open communication about expectations, chores, and privacy can help prevent misunderstandings and preserve your relationship.

4. Impact on Your Social Life and Independence

After divorce, many people look forward to reclaiming their independence and exploring new interests. Hosting adult kids after divorce can put those plans on hold. You might find yourself adjusting your schedule, giving up personal space, or feeling uncomfortable inviting friends over. This shift can lead to feelings of isolation or frustration, especially if your child’s lifestyle doesn’t align with yours. Remember, your home is your sanctuary, and it’s okay to prioritize your own needs as you rebuild your life.

5. Increased Household Expenses

It’s easy to underestimate how much costs rise when another adult moves in. Hosting adult kids after divorce means higher utility bills, more groceries, and increased wear and tear on your home. You may also find yourself covering transportation, medical expenses, or even helping with student loans. These added costs can sneak up on you, making it harder to stick to your budget. Tracking your expenses and having regular money talks with your child can help keep spending in check.

6. Risk of Enabling Dependency

One of the biggest hidden costs of hosting adult kids after divorce is the risk of enabling dependency. While it’s natural to want to help, providing too much support can prevent your child from developing essential life skills. Over time, this dynamic can create tension and make it harder for your child to launch into full independence. Setting clear expectations about rent, chores, and timelines encourages responsibility and helps both of you move forward.

7. Strain on Future Relationships

Bringing an adult child into your post-divorce home can complicate new romantic relationships. Potential partners may feel uncomfortable or hesitant to get involved when your living situation is crowded or lacks privacy. This can limit your ability to date, entertain, or simply enjoy your own company. Being upfront about your circumstances and making plans for the future can help you balance family responsibilities with your personal happiness.

8. Legal and Tax Implications

Few parents consider the legal and tax implications of hosting adult kids after divorce. If your child pays rent, you may need to report that income. If you claim your child as a dependent, there are specific IRS rules to follow. In some cases, having another adult in the home can affect alimony, child support, or government benefits. Consulting a financial advisor or tax professional can help you avoid costly mistakes and ensure you’re making informed decisions.

Reclaiming Your Financial Future

Hosting adult kids after divorce is a generous act, but it shouldn’t come at the expense of your own well-being. By understanding the hidden costs and setting clear boundaries, you can support your child while also protecting your financial future. Remember, your needs matter too. Open communication, honest budgeting, and a willingness to say “no” when necessary will help you—and your adult child—thrive in this new chapter.

Have you experienced the challenges of hosting adult kids after divorce? Share your story or tips in the comments below!

Read More

Why Junior’s Education Might Be Less Expensive Than Expected

Find the Right Amount of Life Insurance in 10 Minutes

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.