Dear Dave,

My mom and dad always told me to live within my means. As an adult, I’ve made some mistakes with money, including falling right back into debt after paying off everything. I’m tired of this rollercoaster, and I want to get control of my finances for good. Can you give me some advice on where to start?

Melissa

Dear Melissa,

It’s frustrating, isn’t it? But making mistakes with money means just one thing. It means you’re human. We’ve all done it. Think about this, though. We’re approaching a traditional time of the year for changes. On top of that, you’re smart enough to have realized what you’ve done in the past hasn’t worked.

Believe it or not, I was once in the exact same spot you are now. When it happened to me, there were three pieces to the puzzle that helped me break the cycle. One was fear. Specifically, I was scared to death that I wouldn’t be able to take care of my family, and that I’d retire broke. Now, don’t misunderstand me. No one should live their lives in fear. But a healthy, reasonable level of fear can provide needed motivation.

Another was disgust. I realized what I was doing was stupid. I was tired of living that way, and I made a conscious, purposeful decision that things were going to be different.

The third piece, and maybe the most important because it’s connected to our spiritual walk, was contentment. We live in a society that’s constantly having the idea that we’ll be happier, or more successful, or more admired, if we’ll only buy this or that product. We’re constantly marketed to, and when we have this stuff in our faces day after day, we can become unsatisfied with just about every aspect of our lives. Don’t let it drag you down. It’s all just an illusion.

One of the things I did to combat this, was to start living on a strict, written, monthly budget. Also, I stopped going places where I was tempted to spend money. You shouldn’t give a drunk a drink, right? So, don’t put yourself in a bad situation when it comes to your behavior with money. If you go wandering through the mall without a specific plan, you’ll lose every single time.

When you go to the store make a list of only the things you need. On top of that, take only enough cash with you to buy what you need. If you can walk in and back out without buying a bunch of stuff that wasn’t on your list, it’s a win. Every time you do this, it’s another win and another step away from your old habits and in the right direction.

You can do this, Melissa. God bless you.

— Dave

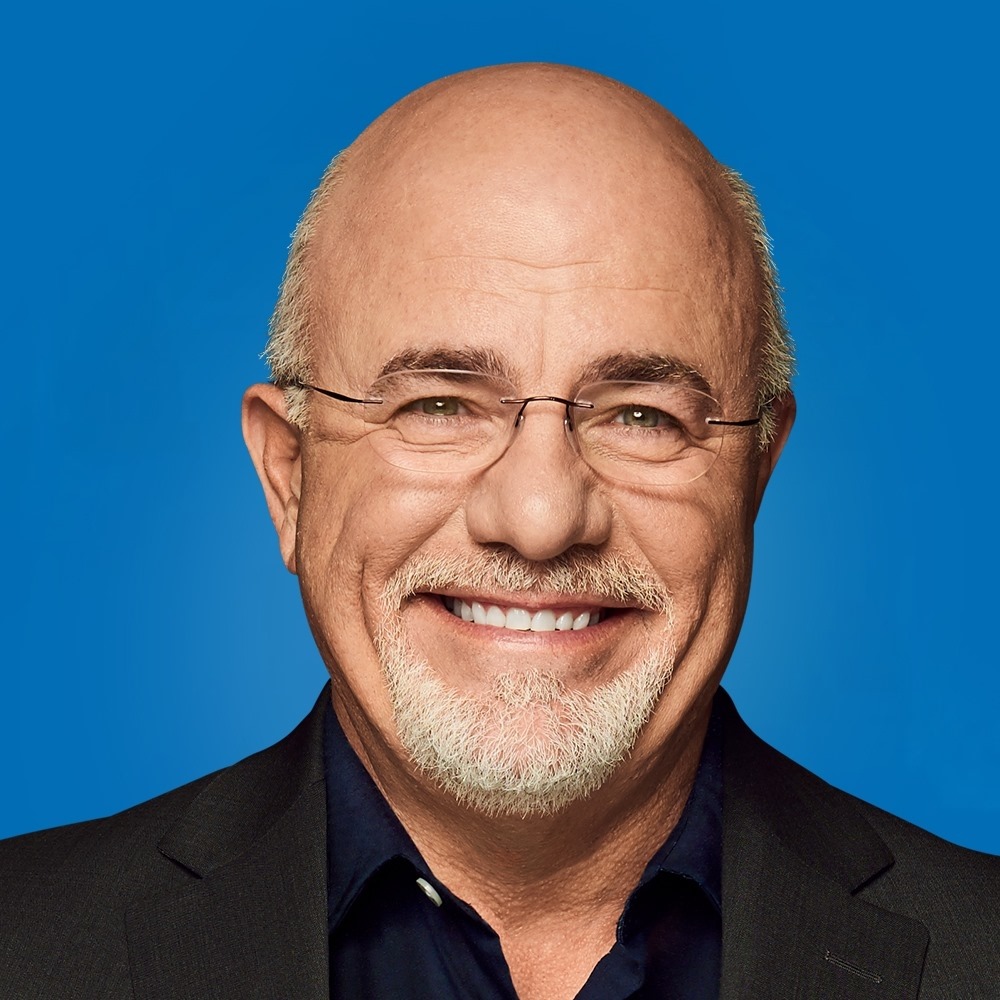

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

Dave Ramsey is an eight-time national bestselling author, personal finance expert, and host of “The Ramsey Show.” He has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions and is the author of numerous books including Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth–and How You Can Too.