Having found out today that the Zune is probably dead, I look at Microsoft and think “this was a good idea gone wrong.” From outside appearances, Microsoft never really identified what the brand “Zune” stood for. At one point it was a music player. Then it was a music service. Now, because Microsoft couldn’t make up it’s mind, it’s soon to be nothing. It seems to be a textbook case of jumbled product design.

The iPod never had that problem.

From the beginning, there was clear differentiation between the iPod and iTunes. One was a service, the other a little sexy looking hard drive that Apple marketed as a music player.

Cool Design Alone Doesn’t Win the Day

But people forget that the first iPod wasn’t a blockbuster; quite the contrary. Initially, in 2002 iPod sales were about 40,000 units a month. That may sound like a ton, but not when compared to the 56 million iPods sold in 2008. The product took some time to catch on. It took consistent backing of the manufacturer and a laser-like focus on the end product without distractions.

In the short time I’ve been blogging, a good number of well-designed and well-written sites have disappeared. I’ve watched blogs implode under the weight of the writer’s unrealistic expectations that if they wrote something (anything) the market would come running immediately.

This “quick success” isn’t limited to blogging. Restaurants open daily without any real planning and end up highlighted on the Gordon Ramsay show Kitchen Nightmares. Viewers like me ask “what were they thinking?” as you see people ill-suited for prime-time trying to run a restaurant.

There are other industries: tech gambles, films, online stores, retail and B2B operations. In each category you’ll find businesspeople who were hoping for quick riches.

In forums I’d see new owners complain that people weren’t coming to their site/restaurant/store. They’d rail against the injustice of lesser companies gaining the traction that they’d wished for. I wasn’t ever surprised when these businesses were gone in a hurry. Inspiration is great, but it doesn’t create an overnight success.

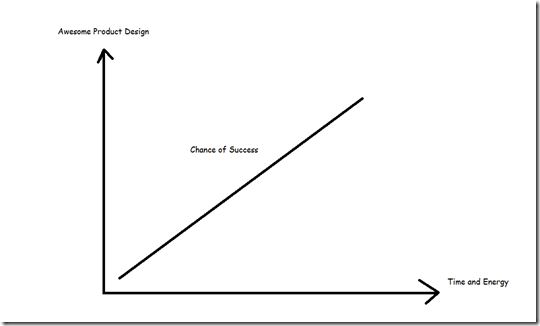

I think you start to understand business when you realize: you won’t be an overnight success. At that point, you’ll go into business with a clear understanding of what it’s going to take to succeed: tireless effort and a long-standing belief in your product.

The band Silversun Pickups was nominated in the Best New Artist category at the 2009 Grammy Awards. The band had been around since 2005….four years! Lead singer Brian Aubert, when asked about the three-year-late New Artist nomination answered: “It’s not lost on us how lucky we are.”

People want instant success, but the wise entrepreneur is ready for the long haul, and feels lucky when they finally find their audience. In most businesses, you don’t have to fall into the “get rich now” trap.

Instead, you can take the longer view:

1) Revisit your product. Do you have a jumbled message or a well-designed idea?

2) Realize that you have a cool product and treat it every day as awesome.

3) Interact with your audience in a way that cool companies would interact with their fans.

4) Be patient, but continue seeking out opportunities to invest in yourself and your chance of success.

Sure, sometimes you run out of patience or money. But if you’ve gone into business with the long view, rather than the “I’m gonna get rich quick” attitude, you’re far more likely to win because you’ve set up your business plan expecting it to be a marathon, not a sprint.

Who knows, four years into your new venture, like the Silversun Pickups or the iPod, you might be the next overnight success.

How do you remain patient about your business?