Image Source: pexels.com

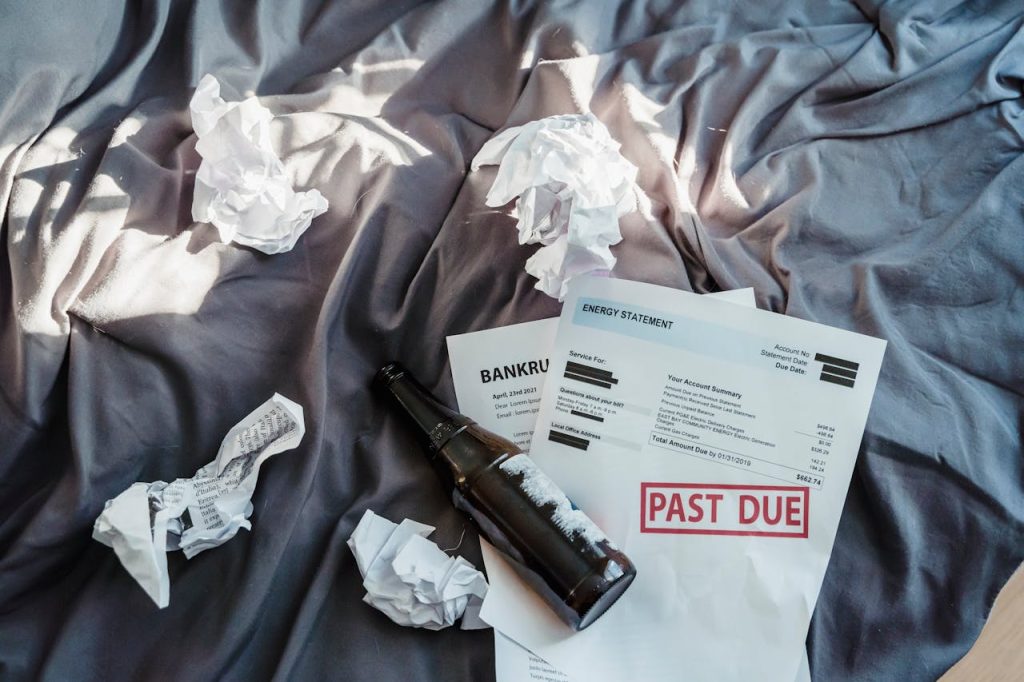

Dating in today’s world can be a minefield, especially when it comes to finances. Whether you’re new to the dating scene or a seasoned pro, you’ve probably encountered someone who seems allergic to picking up the tab. While there’s nothing wrong with splitting costs or being budget-conscious, there’s a big difference between being financially responsible and being downright stingy. Spotting “Mr. Never Pay” early can save you time, money, and frustration. If you’re tired of wondering whether your date is genuinely interested or just looking for a free ride, this article is for you. Let’s dive into the telltale signs that he’s not willing to pay to date you—and what you can do about it.

1. He Always “Forgets” His Wallet

One of the oldest tricks in the book, and yet it still happens all the time. If your date conveniently leaves his wallet at home or in the car more than once, it’s a major red flag. Sure, everyone can be forgetful now and then, but if this becomes a pattern, it’s likely intentional. According to a study by LendingTree, 22% of people have gone on a date knowing they couldn’t afford it. If he’s always coming up short, you might be dealing with Mr. Never Pay.

2. He Suggests Only Free or Cheap Activities

There’s nothing wrong with enjoying a walk in the park or a free museum day. But if every date suggestion is designed to avoid spending money, it could be a sign he’s not willing to invest in the relationship. While being frugal is smart, relationships require some level of effort and investment. If he never offers to treat you or suggests splitting even the smallest expenses, it’s worth considering whether he’s truly interested in building something meaningful.

3. He’s Quick to Accept When You Offer to Pay

Generosity is a two-way street. If you offer to pay for dinner or drinks, it’s nice when your date graciously accepts—once in a while. But if he never insists on taking a turn or even offering to split, it’s a sign he’s gotten comfortable with you footing the bill. According to Pew Research Center, financial expectations are a common source of tension in modern dating. If he’s always happy to let you pay, you may be dealing with Mr. Never Pay.

4. He Avoids Talking About Money Altogether

Open communication is key in any relationship, especially when it comes to finances. If your date dodges any conversation about who’s paying or how to split costs, it could be a sign he’s uncomfortable with the idea of contributing. This avoidance can lead to awkward moments at the end of every outing. If he’s not willing to discuss money now, it’s unlikely he’ll be more open in the future.

5. He’s Generous with Compliments, Not Cash

Some people are quick to shower you with praise, but when the check arrives, they suddenly become invisible. If your date is all talk and no action, it’s a clue that he’s not willing to pay to date you. Compliments are great, but they don’t pay for dinner or movie tickets. A healthy relationship involves both emotional and financial investment.

6. He Keeps Score—But Only When He Pays

Does he remind you of the one time he bought coffee or picked up a snack? If your date keeps a mental tally of every penny he spends, but never acknowledges your contributions, it’s a sign he’s not interested in being an equal partner. Relationships shouldn’t be transactional, and keeping score is a surefire way to kill the romance.

7. He’s Reluctant to Plan Ahead

Planning a date often involves making reservations or buying tickets in advance. If your date is hesitant to commit to plans that require upfront payment, it could be because he doesn’t want to spend money. This reluctance can leave you feeling like an afterthought, rather than a priority. If he’s not willing to invest time or money in planning, it’s a clue he’s not willing to pay to date you.

8. He Makes You Feel Guilty for Expecting Him to Pay

If you ever feel guilty for wanting your date to contribute financially, that’s a major red flag. Mr. Never Pay might use guilt or shame to avoid paying, making you feel unreasonable for expecting a little reciprocity. Remember, it’s perfectly normal to want a partner who’s willing to share both the emotional and financial load. Don’t let anyone make you feel bad for having standards.

Building Relationships That Feel Fair

Spotting Mr. Never Pay early can save you from disappointment and resentment down the road. While it’s important to be understanding and flexible, you deserve a partner who values fairness and is willing to invest in the relationship—both emotionally and financially. Healthy relationships are built on mutual respect, open communication, and shared effort. If you notice these clues, don’t be afraid to have an honest conversation about your expectations. After all, you’re looking for a partner, not a dependent.

Have you ever dated a “Mr. Never Pay”? What clues did you notice, and how did you handle it? Share your stories in the comments below!

Read More

10 Signs a Man Will Never Truly Commit No Matter What He Says

10 Signs Your Relationship Is Based on Financial Gain and Not Love

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.