123rf

Negotiating a job compensation package is a critical skill for any professional. However, there are certain aspects of compensation that are generally non-negotiable, and attempting to negotiate these can reflect poorly on you. Here are ten things you should never try to negotiate in a job compensation package.

1. Standard Company Benefits

123rf

Every company has a set of standard benefits they offer to all employees, which typically include health insurance, retirement plans, and paid time off. Negotiating these benefits is disrespectful to company policies and unfair to other employees. These benefits are often regulated and part of a broader corporate policy, making them non-negotiable. Instead, focus on understanding these benefits and how you can best utilize them.

2. Company Culture and Values

123rf

Negotiating elements related to the company culture or values is a big no-no. These are foundational to how a company operates and maintains its identity. Trying to change these signals that you might not be a good fit for the organization. Instead, align yourself with the company’s values and culture to show you are a seamless fit.

3. Job Title

123rf

While it might be tempting to negotiate for a more prestigious job title, this is typically not up for negotiation. Job titles are often tied to the company’s organizational structure and salary bands. Requesting a different title can cause confusion and create inconsistency within the company. Focus on proving your worth and earning title changes through performance.

4. Payroll Schedules

123rf

Payroll schedules are set in stone by the company’s finance department and are usually in compliance with local labor laws. Negotiating when or how often you get paid will likely be met with resistance and could be viewed as unreasonable. Payroll systems are complex, and altering them for one employee is impractical. Understanding and adapting to the company’s payroll schedule is a must.

5. Working Hours

123rf

Standard working hours are typically determined by the company’s operational needs and industry standards. Asking to negotiate these can suggest a lack of commitment to the company’s workflow. Exceptions to this might include flexible working arrangements, but these should be discussed in a broader context rather than as a negotiation point. Demonstrating flexibility and adaptability will serve you better.

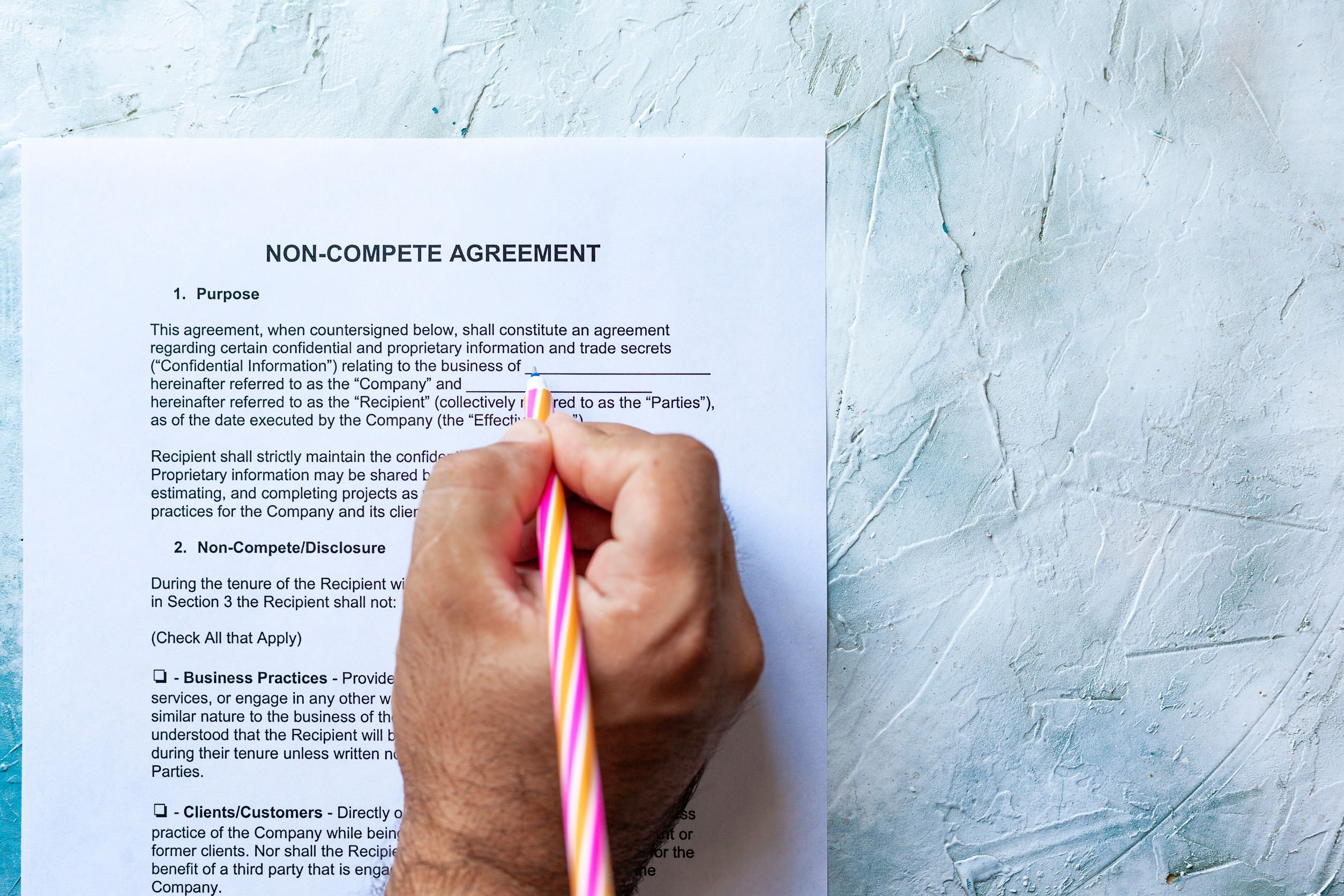

6. Non-Compete Clauses

123rf

Non-compete clauses are legal agreements that protect the company’s interests and intellectual property. Negotiating these is a red flag, suggesting you might have intentions of taking sensitive information to competitors. These clauses are in place to protect the company’s investments in its employees and technologies. Instead, understand the clause fully and ensure it is reasonable for your career plans.

7. Company Policies and Procedures

123rf

Company policies and procedures ensure fairness and compliance within the organization. Attempting to negotiate these could imply you are looking for special treatment, which can be off-putting to potential employers. Additionally, these policies create a structured and efficient working environment. Adhering to them shows your respect for the company’s rules and regulations.

8. Stock Option Vesting Schedules

123rf

Stock option vesting schedules are pre-determined and linked to the company’s financial planning and long-term goals. Trying to negotiate these schedules can disrupt the company’s equity plans and suggest a lack of long-term commitment. In addition, these schedules are strategically planned to align employee interests with the company’s success. Accepting these terms shows you are in it for the long haul.

9. Internal Promotion Policies

123rf

Promotions are usually based on merit, performance, and company policy. Negotiating a guaranteed promotion timeline is presumptuous and unrealistic. Furthermore, companies have set processes to evaluate and promote employees fairly. Instead, focus on demonstrating your value and earning promotions through your work and achievements.

10. Legal Compliance Matters

123rf

Asking to negotiate terms that would breach legal compliance, such as under-the-table payments or unauthorized work arrangements, is not only unprofessional but also illegal. Companies must adhere to local, state, and federal laws, and suggesting otherwise can jeopardize your reputation and career. Always ensure your negotiations are within legal bounds. Ultimately, understanding and respecting legal constraints is fundamental to professional integrity.

The Final Word: Know Your Boundaries in Job Compensation Negotiations

123rf

While negotiating a job offer is important, knowing what is off-limits is equally crucial. Ultimately, attempting to negotiate non-negotiable aspects can damage your reputation and reduce your chances of securing the position. Instead, focus on negotiable elements like salary, bonuses, and specific role-related perks. By understanding and respecting the boundaries of job compensation negotiations, you can approach your discussions with confidence and professionalism, securing a package that works for both you and your employer.