Social media has become an integral part of modern life, shaping conversations, disseminating information, and influencing public opinion. However, its pervasive influence also extends to sensitive topics such as race and gender, often fueling controversies and exacerbating societal tensions. Let’s delve into 14 ways social media is contributing to controversies in these critical areas.

1. Amplification of Hate Speech

Social media platforms provide a breeding ground for hate speech and discriminatory rhetoric, allowing individuals to disseminate harmful messages to a wide audience with unprecedented ease. This amplification of hate speech can perpetuate harmful stereotypes, incite violence, and contribute to a toxic online environment that marginalizes marginalized communities.

2. Spread of Misinformation

The rapid spread of misinformation on social media can have detrimental effects on discussions surrounding race and gender. False narratives and conspiracy theories often propagate unchecked, leading to the dissemination of harmful stereotypes and undermining efforts toward equality and social justice. Additionally, misinformation can exacerbate existing tensions and contribute to polarization within online communities.

3. Cyberbullying and Harassment

Social media platforms have become hotbeds for cyberbullying and online harassment, particularly targeting individuals based on their race, gender, or other identities. This pervasive harassment can have profound psychological effects on victims, leading to anxiety, depression, and even self-harm. Despite efforts to combat cyberbullying, platforms continue to struggle with effectively addressing and mitigating this issue.

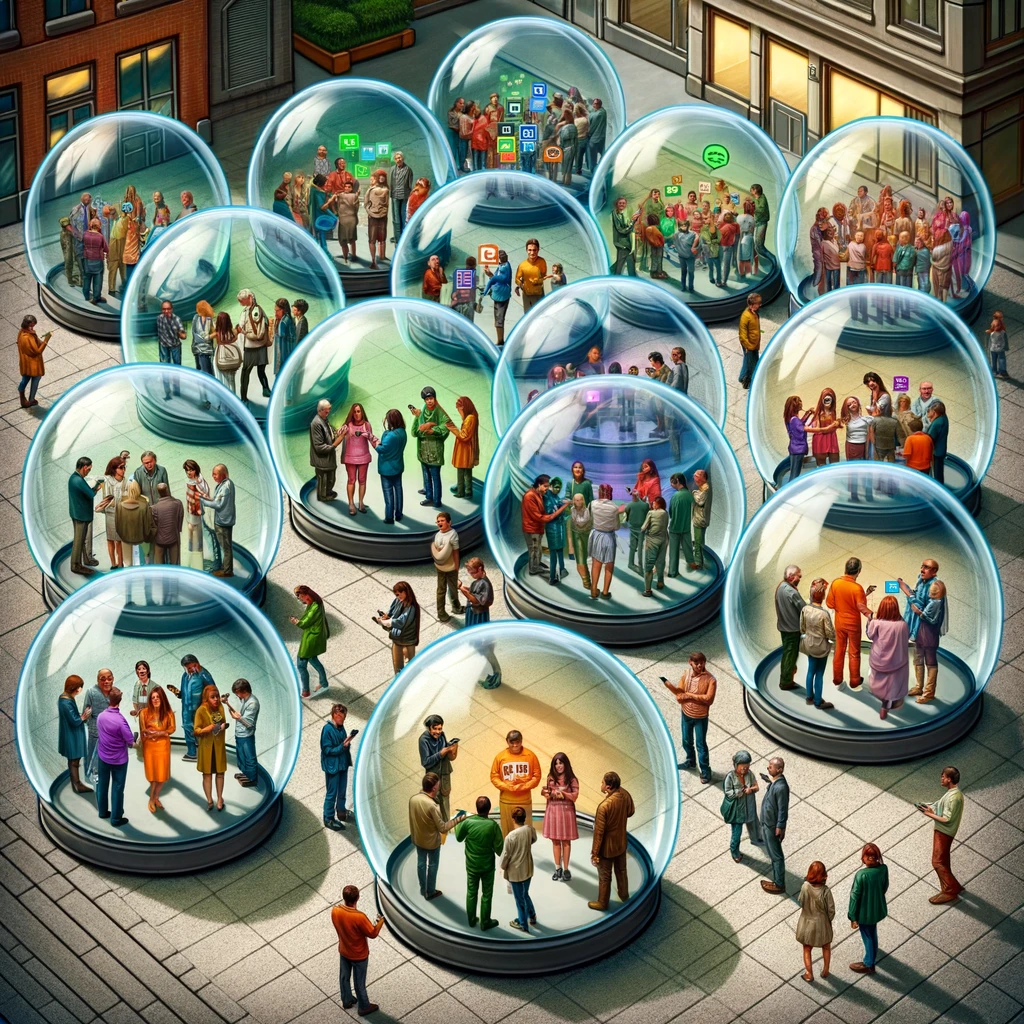

4. Polarization of Discourse

The echo chambers and filter bubbles created by social media algorithms contribute to the polarization of discourse surrounding race and gender. Users are often exposed to content that aligns with their pre-existing beliefs, reinforcing ideological divides and hindering constructive dialogue. This polarization can impede efforts to address systemic issues and promote understanding and empathy across diverse perspectives.

5. Cultural Appropriation and Tokenism

Social media platforms have facilitated the widespread appropriation of cultural elements and identities, particularly by dominant groups. This phenomenon perpetuates harmful stereotypes and diminishes the significance of cultural practices and traditions. Additionally, tokenism—a superficial inclusion of marginalized voices for the sake of diversity—can further exacerbate disparities and undermine genuine efforts towards inclusivity and representation.

6. Performative Activism

The rise of performative activism on social media has led to criticisms of superficial engagement with social justice issues, particularly surrounding race and gender. While platforms provide a space for individuals to voice their support for various causes, genuine action and advocacy are often lacking. This performative activism can undermine the credibility of social justice movements and detract from meaningful efforts toward systemic change.

7. Online Shaming and Cancel Culture

Social media has facilitated the rise of online shaming and cancel culture, wherein individuals are publicly condemned and ostracized for perceived transgressions, often related to race or gender. While accountability is important, the punitive nature of online shaming can lead to disproportionate consequences and undermine opportunities for education and growth. Cancel culture can stifle free expression and deter individuals from engaging in honest discourse.

8. Disinformation Campaigns

Social media platforms have become battlegrounds for disinformation campaigns aimed at manipulating public opinion on issues related to race and gender. Malicious actors often exploit existing societal divisions to sow discord and advance their own agendas. These disinformation campaigns can undermine trust in institutions, exacerbate social tensions, and hinder efforts towards progress and reconciliation.

9. Silencing of Marginalized Voices

Despite the potential for social media to amplify marginalized voices, many individuals from marginalized communities face barriers to participation and representation. Online harassment, algorithmic biases, and systemic discrimination often result in the silencing of these voices, perpetuating existing power imbalances and reinforcing dominant narratives. This silencing further marginalizes already vulnerable populations and hinders efforts towards inclusivity and equity.

10. Algorithmic Bias and Discrimination

Algorithmic bias on social media platforms can perpetuate discriminatory practices and reinforce existing inequalities, particularly regarding race and gender. Biased algorithms may amplify harmful content, prioritize certain voices over others, and perpetuate stereotypes and prejudices. Addressing algorithmic bias is crucial to creating a more equitable online environment and fostering meaningful dialogue on issues of race and gender.

11. Lack of Diversity in Tech

The lack of diversity in the tech industry contributes to the perpetuation of biased algorithms and discriminatory practices on social media platforms. Homogeneous development teams may overlook the needs and experiences of diverse users, leading to the perpetuation of harmful stereotypes and exclusionary practices. Increasing diversity in tech is essential to creating more inclusive and equitable social media platforms.

12. Commercialization of Activism

The commercialization of activism on social media has led to criticisms of the commodification of social justice movements, particularly surrounding race and gender. Brands and influencers often co-opt activist language and imagery for marketing purposes, diluting the message and detracting from genuine advocacy efforts. This commercialization can undermine the integrity of social justice movements and perpetuate superficial engagement with important issues.

13. Echo Chambers and Filter Bubbles

Social media algorithms contribute to the formation of echo chambers and filter bubbles, wherein users are exposed to content that reinforces their pre-existing beliefs and biases. This phenomenon can hinder critical thinking, limit exposure to diverse perspectives, and perpetuate divisive narratives surrounding race and gender. Breaking out of echo chambers and filter bubbles is essential to fostering empathy, understanding, and constructive dialogue.

14. Policing of Language and Expression

Social media platforms often become battlegrounds for debates over language and expression, particularly regarding issues of race and gender. Discussions surrounding terminology, pronouns, and inclusive language can quickly escalate into heated controversies, with individuals facing criticism or backlash for their choice of words.

The policing of language and expression can stifle free speech, inhibit genuine dialogue, and perpetuate divisions within online communities. Finding a balance between promoting respectful communication and allowing for diverse perspectives is essential to fostering constructive conversations on social media platforms.

Social Media and Race and Gender

Social media has profoundly influenced discussions surrounding race and gender, often exacerbating controversies and perpetuating harmful stereotypes and inequalities.

Addressing these issues requires a multifaceted approach, including increased transparency and accountability from social media platforms, education on digital literacy and critical thinking skills, and concerted efforts towards inclusivity and equity.

By acknowledging the complexities of social media’s impact on race and gender, we can work towards creating a more just and equitable online environment for all.

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.