Image Source: pexels.com

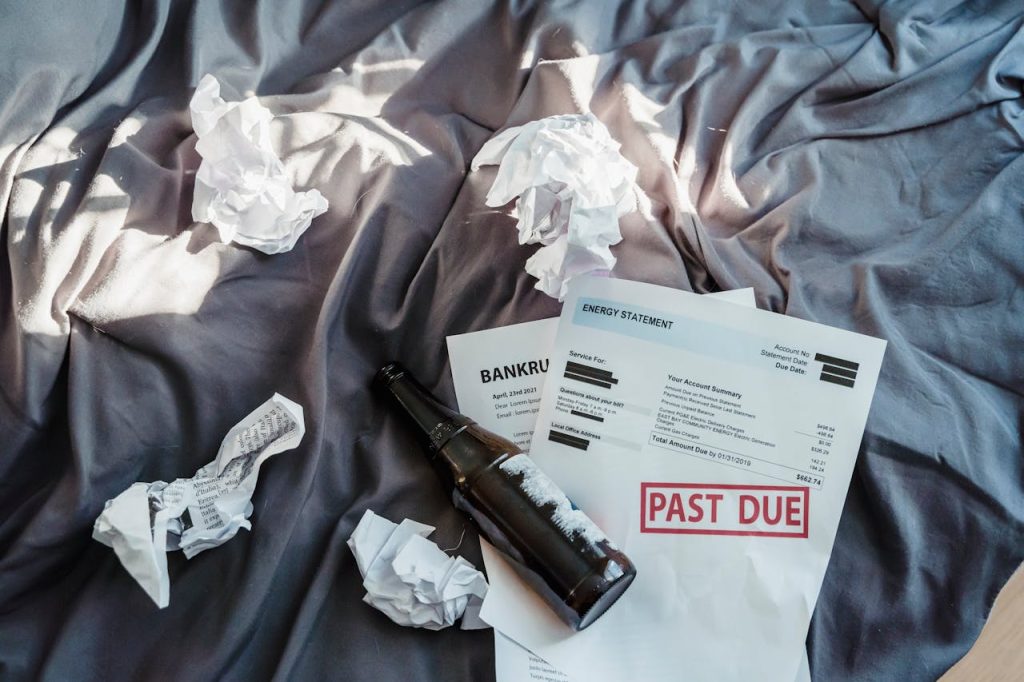

Financial struggles in relationships rarely have a single culprit. When my husband and I were drowning in debt, I initially pointed fingers at his spending habits. It wasn’t until we faced our financial reality together that I recognized my own contribution to our money troubles. This journey of shared accountability transformed not just our finances, but our relationship. If you’re struggling with debt as a couple, understanding how both partners contribute to financial problems is the first step toward lasting solutions.

1. The Blame Game Solves Nothing

When financial stress hits, looking for someone to blame is natural. I spent months criticizing my husband’s Amazon purchases and lunch outings while conveniently ignoring my own shopping habits. This blame-shifting created a toxic environment where productive financial discussions became impossible.

Research shows that financial disagreements are among the strongest predictors of divorce. The longer we stayed in the blame cycle, the more our relationship deteriorated alongside our credit score.

The turning point came when we stopped asking “who caused this?” and started asking “how do we fix this together?” This shift from accusation to collaboration changed everything.

2. My Hidden Financial Sabotage

While I criticized my husband’s visible purchases, my own financial sabotage operated more subtly. I was the household “saver,” but my approach was fundamentally flawed.

I’d set unrealistic budgets that were impossible to maintain, creating a cycle of failure and frustration. I’d impulsively transfer money to savings, leaving our checking account dangerously low and forcing us to use credit cards for essentials. My habit of hiding small purchases that added to significant amounts was most damaging.

According to financial psychologist Dr. Brad Klontz, this behavior pattern—called “financial infidelity”—affects nearly 41% of American adults who admit to hiding purchases, accounts, or debts from their partners.

Recognizing these behaviors was humbling but necessary. My “responsible saver” identity was partially a facade hiding my own financial dysfunction.

3. The Emotional Roots of Overspending

Our spending habits weren’t just about poor impulse control—they were emotional coping mechanisms. My husband shopped when stressed at work, while I made “treat” purchases when feeling underappreciated.

We began tracking not just what we spent but also why we spent it. This emotional spending diary revealed patterns we’d never noticed before. My husband’s biggest purchases coincided with difficult work projects, while mine clustered around times I felt overwhelmed by household responsibilities.

Understanding these emotional triggers didn’t immediately stop the behavior but made the invisible visible. We could now recognize vulnerable moments and develop healthier coping strategies that didn’t involve our credit cards.

4. Communication Breakdown Led to Financial Breakdown

Our financial communication consisted mainly of accusations (“You spent how much?”) or avoidance (“Let’s not talk about money now”). Neither approach served us well.

We established weekly “money dates”—judgment-free conversations about our finances. These structured discussions transformed money from a relationship landmine into a shared project. We used simple tools like shared budgeting apps and a visible debt paydown chart on our refrigerator.

The transparency was initially uncomfortable but ultimately liberating. When we stopped hiding financial information from each other, we discovered solutions we’d never considered before.

5. Shared Goals Created Shared Motivation

Individual willpower often falters, but shared commitment creates powerful momentum. We replaced vague aspirations (“let’s get out of debt”) with specific, meaningful goals tied to our values.

Our first major goal—saving for a modest family vacation without using credit—gave us something positive to work toward rather than just the negative experience of debt reduction. This shift from deprivation to aspiration made sustainable change possible.

We’d remind each other of our shared goals when tempted by unnecessary purchases. This wasn’t about policing each other but supporting our mutual priorities.

6. The Partnership Principle Changed Everything

The most transformative realization was that financial health in a relationship isn’t about perfect individual behavior—it’s about complementary partnership.

My detail-oriented nature made me excellent at tracking expenses, while my husband’s creativity helped us find new income streams. Instead of trying to make each other perfect with money, we leveraged our different strengths.

This partnership principle extended beyond just us. We joined a financial support group where couples shared strategies and accountability. This community approach accelerated our progress and provided emotional support during setbacks.

The Freedom of Shared Responsibility

Accepting my role in our debt was initially painful but ultimately freeing. When both partners acknowledge their contributions to financial problems, the path forward becomes clearer and more collaborative.

Our debt didn’t disappear overnight, but our approach to it fundamentally changed. We stopped seeing money as a battleground and started viewing it as a shared tool for building the life we wanted together. The blame that once dominated our financial discussions has been replaced with mutual support and shared victories.

Has financial blame ever created distance in your relationship? How did you move past it to find solutions together?

Read More

Debt Consolidation Loan: How Do They Work and Its Benefits

6 Ways to Manage Student Loan Debt

Latrice is a dedicated professional with a rich background in social work, complemented by an Associate Degree in the field. Her journey has been uniquely shaped by the rewarding experience of being a stay-at-home mom to her two children, aged 13 and 5. This role has not only been a testament to her commitment to family but has also provided her with invaluable life lessons and insights.

As a mother, Latrice has embraced the opportunity to educate her children on essential life skills, with a special focus on financial literacy, the nuances of life, and the importance of inner peace.