Today’s guest post comes from Susan Lyon, financial analyst with NerdWallet. Thanks, Susan!

What do E-trade, Schwab, and TD Ameritrade all have in common? Aside from being the three largest online brokerages and some of the biggest brand names in investing, they also all charge investors upwards of $7.99 or more on the typical stock trade.

Think this doesn’t sound so bad? Think again. A recent study by NerdWallet found that over 17 million investors are overpaying $1.8 billion every year on unnecessary (and sometimes very complicated or hidden) fees with the largest brokerages.

In light of the ongoing ETF price wars, you’d think a little of this competitive spirit would trickle down into the trading sphere – but this remains to be seen.

Where Is My Money Really Going?

Brokerages all make money by charging commission: that much is plain and simple. But how much is too much, and is the peace of mind that comes from trading with a brand name broker worth it, NerdWallet asks? The data says otherwise.

It’s easy to assume that a brand name brokerage is giving you top-notch treatment and the best money can buy, but NerdWallet’s study breaks down the top 3 brokerages’ financial statements to question this assumption. The key findings:

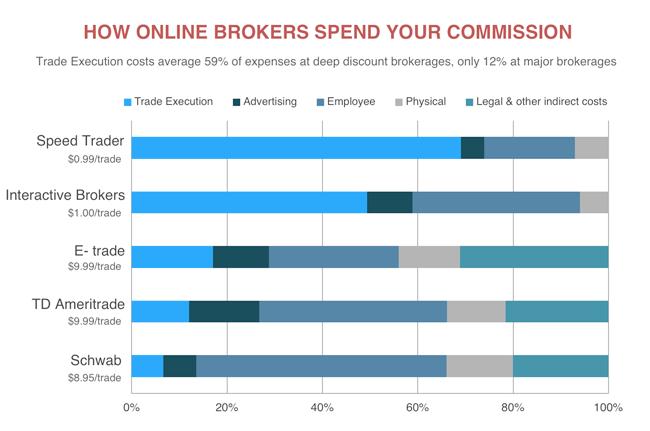

- The big 3 online brokers spend a smaller percentage of their money on trade execution – what benefits the investor – compared to the little guys.

- The big 3 spend far more on advertising and overhead expenses.

This data breaks down expenses at major brokerages by trade execution (what matters to the investor the most) versus advertising, employees, physical, legal and indirect costs:

Lesson learned: active traders can meet their needs just as well by bringing their business to a new firm. The average investor doesn’t need most of the “extras” offered by the big 3 anyways. Why pay for something you aren’t even using?

Investors Can Avoid Fees By Shopping Around

The typical investor with these companies makes between 1 and 2 trades per month, so while a one off expense might not seem like a lot, we did the math and it really adds up. If the typical investor makes only one stock trade per month, of approximately 100 shares, their annual fees at the largest 3 brokers come out to be:

- E-trade $119.88

- TD Ameritrade $119.88

- Schwab $107.40

To make shopping around for better deals quicker and easier, NerdWallet’s new brokerage comparison tool allows investors to compare their many options side-by-side to find the right fit for them.

How Do I Decide on the Best Fit for Me?

NerdWallet’s new tool allows users to do their research before they invest, so they are made aware of all hidden and unpublished fees upfront to avoid unpleasant surprises later on. Investors can search among the 74 brokerage accounts in the search tool by price, research, or data tools – whichever matters most to them personally.

The takeaway: just like in all personal finance situations, make sure to explore all your options before transferring your money.

Photo credit: Joybot

Our account is with TD Ameritrade – but since we are buy and hold investors (and since we only buy when we get a promotional email from the brokerage giving us a few free trades) I’ve never had to pay those $9.99 fees. That said, your bar chart was terrifying – I can’t believe how much those “top” brokerages are devoting to marketing!

Great idea, Elizabeth, waiting for the promotions to make trades in any transaction-inducing positions.

I had been considering a brokerage account with Schwab but will now re-consider. Good to know NerdWallet offers a brokerage comparison tool, which is something I certainly will keep in my financial arsenal while shopping around.

What a great comparison! Thanks for doing all of this research NW! I have an old account at Etrade that I hardly ever make trades through, so I’m fine with the $9.99 fee. For an active trader or somebody that makes multiple trades a month, I certainly see how shopping between the firms makes a lot of sense!

I remember when my Fidelity account went from $20 a trade down to $8 per trade, I thought that was pretty good. Now you’re telling me there’s one where its $1 per trade? That sounds pretty good! But it does scare me a little bit to use a company I am not familiar with or that has not built up a good reputation. It makes me ask: What assurance do I have that my brokerage account will still exist the next day?

You must ensure any brokerage firm you are dealing with is insured through SIPC. Similar to FDIC, it is coverage for brokerage accounts that protects your assets if the firm goes out of business.

Keep in mind, the coverage does not protect from INVESTMENT losses (and with these types of accounts you are typically making all of the decisions yourself). But a proper firm has this coverage. It protects 500k per investor, 100k of which can be cash.

If you cannot find that the firm is covered…steer clear.

I’ve used both expensive ($9.99/trade) and cheaper ones before. What I’ve found is that you get what you pay for. With TD the trades are a little more expensive, but they have way better tools and trade execution than cheaper ones like Zecco. I’ve also found that the customer service with TD is top notch. Those trading commissions are negotiable and you can get them to reduce them. I guess it all depends on the way you invest.

After all of my years advising clients, I’d still say that most people haven’t compared brokerages at all. They have no idea about the huge gulf in fees or features between even these listed on the NerdWallet chart.

Ugggh! The dread fees, I use to hate those. Luckily my account is large enough that they do not charge me fees. I did however have to threaten to take my account else where before they gave me that option.

…and they kept the account there, Marvin? Often, I’ve witnessed people threaten to leave and brokerage services say the equivalent of, “Don’t let the door hit you on the way out!”

Wow!

I’ve never even heard of SpeedTrader… but then, I guess that’s the point (and why they spend more on transaction fees than advertising?)

The graph showing how commission is allocated by the brokerages is quite shocking. So I am assuming the actual cost of a trade could be much lower than what is advertised. I used tradeking a lot last year, less than $5 a trade which makes me feel a little better. I’m curious how Schwab gets their cost down so low for trade execution?

nice and informative post.