When words don’t work, I’ll emulate my buddy PK at the DQYDJ blog and resort to graphics when explaining your investing options. Since I can’t personally be bothered to create any type of creative chart, I’ll instead use a graph that I received from a friend.

Before we peruse this particular investing chart, I should introduce it, like a big star explains the movie clip:

People worry often about risk when investing. You should. It doesn’t make sense to risk your portfolio without knowing what type of return you’ll receive.

As an example, one of the riskiest investment classes is art. I know and you know that your dogs-playing-poker is probably a timeless classic, but beauty is definitely in the eye of the beholder on that one. Unfortunately, if you paid $10k for your Velvet-Elvis-and-the-Eagle rug, that’s probably considered a capital loss.

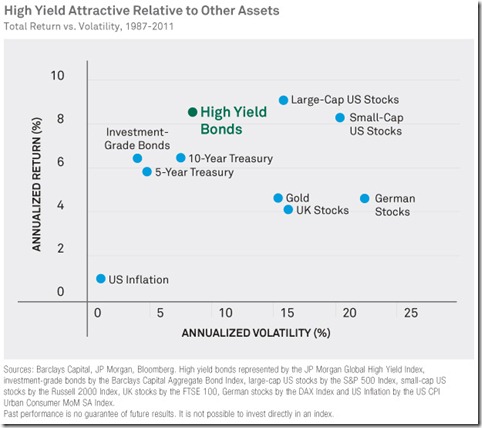

Here is the risk/reward profile of high yield vs. other asset classes:

People are generally shocked when they see the risk/reward profile of high yield bonds. Is it true that JUNK BONDS are significantly less volatile than large-cap stocks?

Yup.

High yield bonds aren’t much more volatile than 10-year treasuries (which, ironically, have been more volatile than investment-grade bonds)?

Yup again. I knew people who came to this website are flippin’ brilliant.

Maybe now is a good time to review my posts last week on the topic of high yield bonds:

Off topic: Check out German stocks. Lots of volatility, plus those people wear black socks with sandals. I don’t know what those two points put together says, but it sure feels awkward.

How about you? Does this chart surprise you? Can you see my love affair with high yield? Make you laugh? Improve your outlook on life?

I’m surprised the return on small caps are lower than large cap stocks. Everything I’ve read shows that they outpace large caps by a few percent.

That’s pretty awesome about the high yield bonds though…I need to start looking at them a little more seriously.

You may want to let the dust settle from the JP Morgan debacle before using their bond return numbers….

“Junk” can be a misnomer. A lot of the holdings are companies you probably do business with or hear of everyday. I *think* junk is anything S&P labels as BB or below…but I could be mistaken. Nonetheless, they are big companies that many people are comfortable with holding their stocks.

Ha! Of course you know it’s the JP Morgan index, not their bonds, Bichon. Don’t make me laugh like that while drinking coffee.

That’s exactly why I l.o.v.e. this category (or at least this: I don’t fear it). When you read what’s in a “junk bond” fund, you’ll be surprised by how many of the firms are (as you described) household names.

I’m probably only a few steps away from making all of my verbal content embedded in my graph or alt tags. Words bore me!

I look at my Tax Free California Munis as high yield bonds right now, haha.

…assuming you purchased them recently. If you rode them down I feel for ya’, PK.

I have seen claims like this before. The book “Higher Returns from Safe Investments” was very persuasive about sticking with various types of bonds over stocks, and had plenty of data to make the case. I thought twice about how important “riskier” bonds needed to be in my portfolio.

This is interesting, and yet it wasn’t all that long ago that most people were primarily invested in fixed-income assets. Well, I guess if you count a half-century as not that long ago.

Either way, I think there’s always a lot to be said for going to the second-riskiest (just run with the idea bonds are less risky) investment and then taking the most risky in that category. To be fair, though, high-yield securities definitely had a sail behind them in the form of falling rates from 1987 to today.

It was a bumpy ride, but you’re right, it was a sail. If I’m reading this graph, I’m not expecting HY bonds to continue to stay close to stocks, but I am intrigued that they haven’t proven to be much riskier than other asset classes of bonds….