Shannon Ryan joined us to kick off the new Stacking Benjamins podcast yesterday, and we received a ton of great feedback and requests to “get this in writing.” So, we owe a big thank you to Shannon, who sent over her tips for us. If you missed the podcast, here are some great tips to help kids learn about money. Enjoy!

Summer is the perfect time to start talking to your kids about money as life is less structured, and you have more time to slow down and have these important conversations. And don’t worry–money conversations do not have to be boring! Position them correctly and you can have fun while teaching your kids good, life-long money habits.

1. Set Clear Goals and Make It Fun

Over a favorite family meal, we discuss how we’re going to use our family money in three areas – what will Save our money for; what will Spend our money on; and who will we Share our money with? If your children are older than 6, have them create their own summertime money goals. For example; Save–for a new bike; Spend–during a trip to the ice cream store; Share–with a local charity, such as the humane society where you can deliver your donation in person. Once your kids have their goals, help them find fun ways to earn money. For example, post jobs in the house, a lemonade stand, etc.

Fun Activity: Make goal-setting a fun event and your kids will no longer dread the word “goals”. Celebrate achievements and create friendly, sibling competitions on who can reach their goals first.

2. Slow Down and Have Regular Money Conversations

Some of my best money conversations with the girls happen during our normal activities. For example, take your kids shopping. Have them help you prepare the shopping list to create a clear understanding on what the family “needs” are and where “wants” fit in. At the store, be sure to talk through your purchases with your kids instead of making internal comparisons. For example, why you buy a name

brand vs a store brand for one item and not another.

Activity Idea: See how much money you can save on groceries for the summer. Make a list of needed items and search for coupons and specials. Use the money saved for something fun.

3. Make Your Goals Visual

Post family and individual goals where everyone can see them. You can cut out pictures from magazines or print pictures from the internet to create a vision board for your goals. Set up jars or envelopes for their Save, Spend and Share goals. When they earn money, discuss with them how they want to allocate their money towards their goals.

Activity Idea: Have you kids decorate their jars or envelopes with images of the things they plan to save, spend and share their money on or with.

4. Post Jobs so the Kids Learn How to Earn Money

I am not a believer in allowance, but I do believe you need to find a way to put money in your kids hands, so they can learn to make decisions around it. Each week create a job posting that consists of various chores that are important to running the house, but outside the children’s expected responsibilities (in our house, this includes–making beds, cleaning dishes and cleaning up after themselves).

Fun Activity: Weekly job postings allow kids to pick and choose which jobs they want to do. Plus, they can choose whether to do a lot (and earn a lot) or do little (and earn little). We treat this like a real job and on pay day, if they haven’t done their work to my satisfaction, they may not get paid. Or if they have gone above what the job entailed, they could earn bonus.

5. Let Them Flex Their Decision-Making Muscles!

We all have a finite amount of money, so the earlier you can teach your children to make wise choices with their money–the better! One of the best ways to teach them is to involve them in the decision-making process. You want them to figure out what makes them truly happy, rather

than listening to what others tell them they need. Once they master this, they will spend their money on the things they want and learn to create joy with any amount of money.

Fun Activity: Create an entertainment budget. Give your kids multiple options, some expensive and some not, then let them figure out how to use the money.

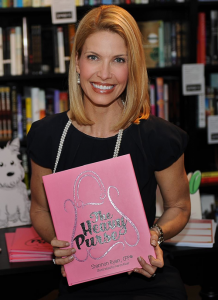

Photo: Mosieur J.

Shannon Ryan, CFP® is a Mom on a mission to help busy parents teach their kids simple, value-based principles that guide their money decisions and support their long-term financial well-being. Shannon wrote The Heavy Purse to help parents start money conversations with their children through a fun, bedtime story and developed companion workbooks to help deepen those conversations. Visit www.TheHeavyPurse.com to learn more on how to raise Money Smart Kids.