Okay, I know. The original line in Entourage was “Hug it out, bitches,” but it’s my blog and I’ll twist words for my own devilish devices.

The #1 line people would use in my office back in the day:

“I can’t save money.”

It was usually younger people who’d say this, but not always.

I had one solution, every. single. time.:

“Let’s write it out, bitches!” (…minus the bitches part. That wouldn’t have been great for biz.)

Often, just the process of turning thoughts into visuals can quickly uncover opportunities you never knew you had. Your brain has a love affair with visual cues. Many people become jumbled when they hear words, but if you put pictures in front of them, it’s magic. Heck, that’s why Sherlock Holmes has been so popular. Everyone knows that if you just look a little harder, you’ll find the right clues to solve the mystery.

In this case, adding visuals will help us find money where we thought there was none. It’s like the ending of the mystery: The Great “How Did That $10 Bill Get in My Pants Pocket” Caper.

Sherlock Holmes used simple tools around him to solve the crime. Let’s do the same:

So, let’s play around with this mystery on the nifty little Planwise tool on our site.

Meet Steve & Sarah.

They are two awesome hypothetical clients of mine. Steve works for Starbucks and earns $2,000 per month. Sarah works as a financial blogger, and (just like the rest of us), is just killing it, making $2,200 per month (inside joke for blogger friends reading this). Both of these numbers represent take-home pay.

Got it? Cool. Let’s interrogate our witnesses.

Goal Time.

As clever sleuths, we begin by grilling Steve and Sarah about their savings game plan:

1) They’d like a home. Their little apartment is busting at the seams with four people inside. They’ll need $20,000 minimum for a down payment and mortgage closing expenses.

2) They also know that if they start early, they can get education for their children settled. They don’t want to pay for all of their children’s college, but if they can pay half of an in-state university, they’ll be happy.

3) Finally, they want to retire someday, so they decide to set their sites on age 65.

Why is this relevant, Joe? I thought this was a story about being able to free up money?

It is, but until we know exactly what we’re saving toward, Watson, there’s really no sense. Every crime has a motive. Savings goals also have motives. “Why?” is the best question you can ask yourself.

- “Why are you saving?”

- “Why do you want that goal so badly?”

Sure, it might not be a concrete goal. You might want flexible money for trips or whatever, but there’s gotta be something driving you to change your habits…something to change your life.

Once we have those on paper, we can use them as evidence of why something today should be cut out.

Budget Away

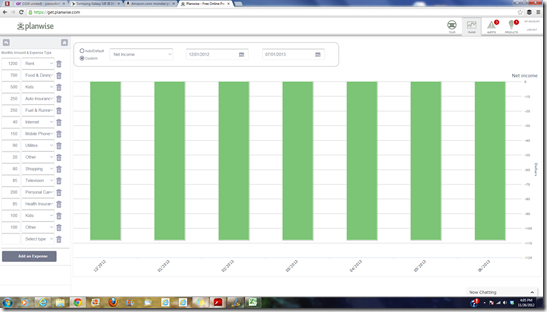

To get an idea of their situation, Steve and Sarah quickly jumped on the Planwise tool on our site. It’s only a matter of minutes to add in expenses and produce a graph like this:

As they expected when they said, “We can’t save,” the Planwise graph shows them in the hole just over $100 per month. Now that we know the situation today, let’s start looking for visual clues.

Using my mad Sherlock Holmes skillz (you know AC Doyle was fond of “z”‘s, don’t you?) I’d break Steve & Sarah’s expenses into two types:

- unlikely suspects

- likely culprits

Example of an unlikely suspect: I could tell them to cut the $90/mo. utility budget. Realistically for a family of four this could get down to $75/mo., but there are easier wins for $15.

Let’s look at those more likely culprits instead:

– $1,200 Rent. If they can find cheaper digs, this could save them huge dollars. I know….this isn’t popular with people, but it’s the biggest expense on the sheet. It should be thrown into question.

– $150 Mobile Phones. If we could find a way to make this $50, we’d quickly save $50.

– $85 Cable TV. Easy win if they disconnect cable.

– $200 Personal Care. When I’d point to this one, someone in the house would always sigh. For some, giving up their relationship with the hair stylist is like telling grandma you won’t be coming to Thanksgiving. That’s huge money, and can be easily cut.

– $80 Gifts (I’ve called it “shopping” in the Planwise tool). If you aren’t reaching your goals, giving gifts should take the back seat.

How did I find these ones? Generally, they’re bigger numbers. Second, I reasoned what the smallest number could possibly be. By just surveying the list for the biggest numbers and eliminating the ones that can’t be reduced quickly, I came up with a strategy to share with my client.

Sometimes experience helped here (you’d see clients get really creative with their budget), but generally it didn’t. I just learned to look more closely at every number and ask “Why?”

What They Decide

In this scenario, they’re happy cutting gifts back to $25 (kids parties are more difficult to cut than you’d imagine) and eliminate cable tv.

That makes the Planwise graph look like this:

They now have $30 per month in their hot little pockets and a balanced budget, right?

Wrong.

Without goals, the Steve and Sarah’s of the world always choose to cut just enough to get to even.

Unfortunately, they also need savings and adequate insurance. We’ll have to cut more, but not until we find out how much more.

That’s because there’s not a reason for them to save more than they really need. Why continue saving money if there are things they’re cutting now that they’ll enjoy?

See how fun it was writing it out?

Another day we’ll use the Planwise tool to check out Steve & Sarah’s ability to save for a house, education and retirement.

What planning tools do you use to project your savings needs? When looking for money, what you you bitches found by writing it out?

Photo: shining.darkness

I really like this post and your call to action “let’s write it out, bitches.” I think I might borrow that next time someone complains about having no cash.

My secret planning tool is MS excel, nothing fancy, but does the job of calculating everything I need. Plus I can write my own scripts to do any fancy little things that I want.

Funny how many people use Excel. I’m a gadget geek, so I’ll play with Planwise or Mint.

I dare you to say “Write it out, bitches!” No, Glen, I double-dog-dare you. (Timely holiday movie reference)

Whatever you do, don’t stick your tongue on a lightpole in winter!

Such a classic movie.

I actually just use an Excel file I’ve created. I record all our spend in there from each of our accounts (bank/debit, credit cards, cash, etc.). I have categories, probably similar to other budgeting tools. I’m sure tools like planwise, Mint, etc. work well for most people but I like having the raw data to mess around with (again, I realize some tools have an export feature so that could work as well). I think the biggest thing is being able to see your monthly spend as well as your month-over-month spending trend. Ours looks a bit funny the past few months with the new home purchase and everything that went into it 😉

I bet your Excel spreadsheet is crazy now, DC. It’s amazing how many little things go into a house purchase.

Writing it out really helps to not only see what you’re spending but track it as well. Obviously we do this in our budget every month, but we also do it for big events like Christmas. By having a Christmas tracking sheet it is easy to stay on track for costs. I know, because I’ve been without one and then wondered where all the $$ went.

Another twist on this is writing out your debt and visually seeing a debt payoff plan. If you are in debt and haven’t done this, I highly recommend it. It will give you a lot of hope and drive in paying it off.

Well written, Jason! Trackig how much you spend in the “big events” is a huge win. Sadly, the number is usually WAY bigger than you thought it was, had you not tracked it.

We have always used old fashioned pen and paper to write our budget and it works great. When we started budgeting, we really saw where our money was going and it was absolutely terrifying! We made plenty of money, but spent it all. Writing a budget changed everything.

Pen and paper? What the hell are those things? Is that some kind of crazy new iPhone app, Holly?

Whatever Joe. We may be old, but you grew up with slide rules. 😉

I completely agree with the magic of visuals. I personally use Excel to set up our budget and track things. I’ve been using the same setup for years now and it’s been great. We used t for our normal budget as well as retirement investing, big ticket purchases, and when we had it debt. Being able to see what our number was or is and seeing each entry get us closer to what we want is a big incentive.

Using the word bitches at work is always acceptable in my book 😉

I don’t know what’s funnier – her making $2,200, or her reporting making $2,200 but actually having $2,199 in expenses. Help me decide what to laugh at!

I think that’s the TRUE hilarity behind her being a blogger….

Great post, your writing has a really great call to action. And using visuals REALLY helps.

Budgets are so important. Our spending was so crazy before we implented one!

I was completely in the dark until I took my credit counselor’s advice to start tracking on a spreadsheet. I tried using Mint for awhile, but found that I felt more in control when it was my own tracking method. My first step was to carry around a small notebook EVERYWHERE I went and writing everything down immediately. That way, I only had one place to look when I went to log everything in the spreadsheet!

Of course, don’t be the person that holds up a line to write in your book… step aside, step aside.

Dang, Steve and Sarah are making BANK for their positions! 😛 I find that when I’ve got stuff written out it helps a ton. I need to sit down with the BF and do this, though. Not because he doesn’t stick to a budget, but just because we haven’t in a while.

Wow…for once an example where the wife makes more than the husband.

I have to say that I am an Excel fan as well, having used it at work for so many years. I created a budget in January to cover everything and revise it every few months. We have cut all utilities to as low as we can. We signed up for a budget plan for gas\hydro too. Our cell phones are pay as we go and only for emergencies so not much expense there.

Instead of complaining about having to control our spending each month we look at the numbers and make it a game or a challenge to see where we can spend less the following month. It makes it fun, and it helps that both my husband and I are on the same page.

Tracking is huge. Why make a budget if you don’t track it? Since we’ve been budgeting a while we know how much to save for Christmas and other expenses. We use old budgets from previous years. Been playing with YNAB recently and enjoying it, though it is a different concept from any other budgeting software I’ve used.

I can’t wait for your YNAB review, Brent. I have a friend who just bought it here (a guy I sit with at high school football games). I was surprised when he said, “I just bought this cool software called YNAB.”

next can we talk about how to get her kind of income?

I know. She’s a big time blogger.

Funny, educational, realistic. Looking forward to the rest of the series.

Srsly, write it out, bitches is always the answer! I had a friend of a friend hit me up on facebook as say “my husband can’t seem to get a grasp on budgeting, help?” And I replied with a lengthy, superfluous response with equations and big words explaining the tremendous benefits of compounding interest and the stories of the ‘Budgeteer’ and his conquering of the excel spreadsheet. But then I deleted all of that and told them to write down everything they’ve spent over the last two months. Sometimes a dose of financial reality is the best motivator. And to listen to a Dave Ramsey show or audio book.

And then to go to Average Joe’s Money blog to figure out everything else in life…

Sucking up to the host is always the winning approach, Jake. You rock, my friend!

I love your story. I’ve done that a hundred time, too. Back it down and hit the basics.

I remember writing down one of my first goals when I was very (7 y.o.) young. I wrote down my goal and found a way to earn it. It was the beginning of something big

Now my curiosity is up, KC. What was the goal?

I’m fairly mint-obsessed as I’ve been using it to track spending since it was in beta testing. But for making projections about how to generate income or pay down debt in the future, I stick with my own home-brewed excel spreadsheets.

I love a good pivot table to test how different tweaks on input variables can make big changes in the future. =)

Amen! I love playing with financial software just to see “okay, if we change this one thing….” I had others input my financial plans for clients because I’d spend too much time playing around with it. Every time I was close to the software myself I couldn’t stop tinkering…..

Planwise is a really nice tool. I hear so many people complaining that they have no idea where money goes and have nothing left at the end of the month when after 5 minutes of talking I can point ten areas of obvious overspending. Writing it down makes it obvious for them too.

It’s also weird that it’s usually easier for others to see than you, isn’t it? That’s always the case. I have no idea what I’m doing wrong, but when someone else points it out to me, it’s SO obvious.

I am finding so many fun things today. I don’t know whether I like “Write it out, bitches” or Fearless Men’s “Eveyone in Hell wants a slurpee” better. It is really amazing how much you can find to save if you sit down and put it all out there. Steve and Sarah can always come live in my rental for $750 a month.

Kim, you’ve got the ABC’s down on that rental! Always Be Selling. Sweet!

This broke-ass bitch keeps her end goal in mind and is ruthless with triumphing. Bwahahahaha!

Actually I conquer my financial goals significantly quicker when I commit them to writing. 🙂

Know we know who the queen of the evil empire REALLY is….

Ok you win making me laugh out loud for the day. Funny you should post this because I posted a guest post of a family I was tagging along with this year and their finances. It wasn’t until she wrote it out that she could see where the money was going. It is the MOST important step when budgeting because you can’t budget what you can’t see. We document every expense in our spreadsheet and budget our money accordingly. Has it changed, almost every month, has it helped us save… You better believe it!!! Great post mate. Mr.CBB

The TRUE goal of the piece was to see if we could make Mr. CBB laugh. Now that’s done….it’s nap time!

Great title Joe. Like others, I’m a big fan of Excel also. I love the fact that I can use formulas like present value, future value, payoff time, etc.

Having the visual of the budget has made my life so much better. It takes work but the payoff of being able to save more and know where my money is going is priceless.

Especially with the income problems you’ve written about, B&B….I can’t imagine how you’d do it without it.

Lots of Excel fans. I love it. Great read Joe and great illustration. I’m on my way to check out Planwise…and here I thought I’d heard of them all. Cheers!

It shows how much people like the “keep it simple” approach. Plus, I think it’s probably the one tool most of us used in high school. Maybe it’s also because it’s comfortable?

I use Quickbooks and it automatically creates bar graphs and pie charts. I can see where my money is going and where I’m, ah em, squandering it. It gives me a plan for the next month. As for Sarah’s income, yes, can we discuss how she’s making that! 😉

I used a good old fashioned fancy excel spreadsheet and yodlee.com

Yodlee? What’s that? 😉

Great post, who knew saving could be so fun my dear Watson?;)

I’m old fashioned though, i stick with a good old excel document! But have been known to use Mint once or twice, only because it’s free really! haha

Who you calling a bitch? Haha. Awesome post. I use Mint, but should seriously put more effort in using the goals feature. That’s some big time blogger take home income. This is secretly you right? How’s life after the big reveal? Seems like you’ve kicked it up a notch, BAMM!

Love this post — and linked it in my latest roundup. As I said there, writing things down is a very powerful step. It’s hard to ignore your bad habits when they’re staring you in the face in black and white.

Budgeting and thrift are a hard act to accomplish in our current immediate gratification world. But for those who can somehow find a way to budget, there is definitely a reward at the end of all this. Great post with an excellent example and model for success in this area.

Thanks, Steven! You’re right on. It’s a “right now, I don’t care what it costs” world we live in. Maybe it was prophetic when Dire Straits said “I want my MTV.” MTV and more….now!