Image source: pexels.com

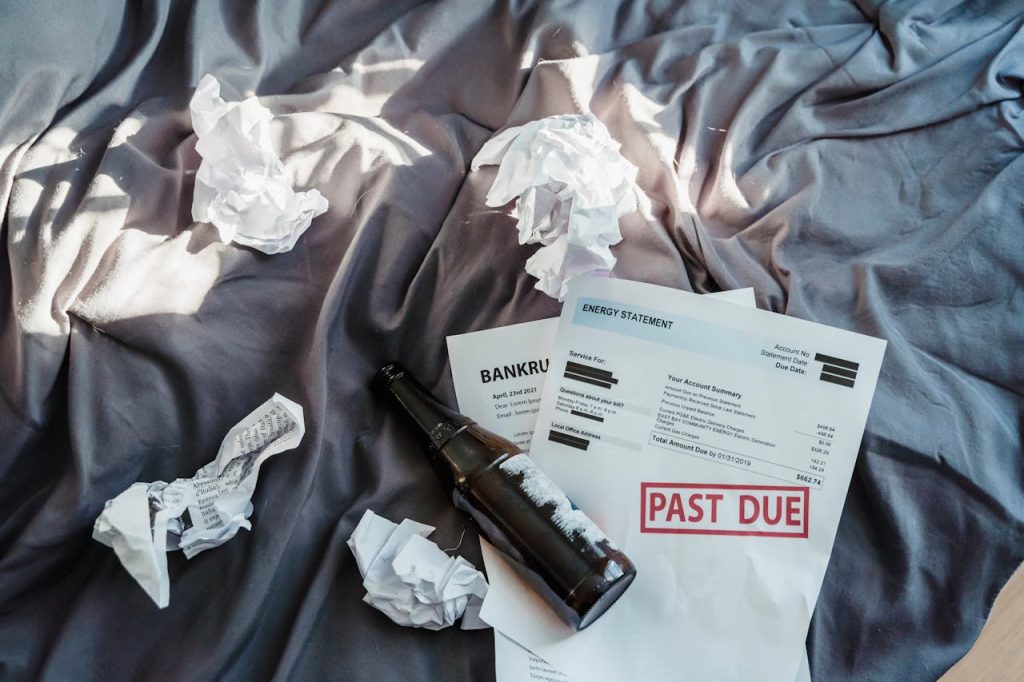

Filing for bankruptcy is often seen as a last resort for individuals overwhelmed by debt. While bankruptcy can offer a fresh start, it’s not a decision to make lightly. Many people focus on the obvious expenses—like attorney fees and court costs—but overlook other financial and personal consequences. These lesser-known costs can impact your future in ways you may not expect. If you’re considering this path, it’s crucial to understand the full picture before proceeding. Here are five lesser-known costs of filing for bankruptcy that you should keep in mind.

1. Long-Term Credit Impact

Your credit score will take a hit when you file for bankruptcy, but the effects extend far beyond the initial drop. Bankruptcy can stay on your credit report for up to ten years, making it harder to qualify for loans, rent an apartment, or even secure some jobs. This long-lasting mark means higher interest rates and less favorable terms if you do manage to borrow money. Lenders may see you as a risk, and rebuilding your credit can be a slow process. Even after the bankruptcy falls off your record, some lenders may still ask about your financial history, potentially affecting your options for years to come.

2. Loss of Non-Exempt Assets

Most people know that bankruptcy can lead to the loss of certain assets, but the specifics often come as a surprise. In a Chapter 7 bankruptcy, for example, the court may seize non-exempt assets to pay creditors. This could include valuable items like jewelry, a second vehicle, or even some equity in your home. Exemptions vary by state, so what you get to keep depends on local laws. If you have property or possessions that fall outside those exemptions, you could lose more than you anticipated. It’s important to consult with a qualified professional to understand exactly what’s at stake before filing for bankruptcy.

3. Higher Insurance Premiums

Many people are unaware that filing for bankruptcy can impact their insurance costs. Insurers often review your credit report when calculating premiums for auto, home, and even life insurance. A bankruptcy filing signals financial instability, which can lead to higher premiums or, in some cases, denial of coverage. While laws prohibit insurers from using bankruptcy alone to deny coverage in certain cases, your overall credit profile may still play a significant role. Over the years, these increased costs can add up, quietly draining your finances long after your debts have been discharged.

4. Limited Access to Credit and Services

One of the lesser-known costs of filing for bankruptcy is the difficulty you may face when trying to access credit or certain services. Many credit card companies and lenders will either deny your application or offer you products with high fees and interest rates. Even utility companies may require a larger deposit before starting service, and cell phone providers might limit your options or require a co-signer. This restricted access can make everyday life more complicated and expensive, especially if you need to replace a car or move to a new home.

5. Emotional and Relationship Strain

While not a direct financial cost, the emotional toll of bankruptcy is significant and often underestimated. The process can be stressful, with feelings of shame, anxiety, or failure affecting your mental health. Relationships with family and friends may become strained as you navigate these challenges, especially if you have to explain your situation or ask for support. This emotional burden can spill over into your work life and other areas, impacting your ability to move forward. It’s important to seek support, whether from loved ones or professional counselors, to help manage the psychological impact of filing for bankruptcy.

Planning for a Financial Fresh Start

Filing for bankruptcy is a major decision with consequences that go beyond wiping out debt. The lesser-known costs of filing for bankruptcy—like long-term credit damage, asset loss, and emotional strain—can shape your financial future in lasting ways. Before taking this step, consider all the hidden impacts and explore alternative solutions, such as debt management plans or credit counseling.

Have you or someone you know faced unexpected challenges after filing for bankruptcy? Share your experiences or questions in the comments below.

What to Read Next…

- 5 Things That Instantly Decrease Your Credit Score By 50 Points

- 5 Emergency Repairs That Could Force You Into Debt Overnight

- 7 Hidden Fees That Aren’t Labeled As Fees At All

- 7 Financial Loopholes That Lenders Exploit Behind The Scenes

- 5 Invisible Service Charges Eating Into Your Bank Balance

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.

Leave a Reply